The 11 best corporate credit card expense management software solutions in 2025

Making sense of the corporate card expense management software market.

Ken Boyd

Corporate cards are a financial tool businesses use to make it easy for employees (cardholders) to pay for business expenses and manage budgets.

However, without the right operations, processing corporate credit card expenses can take finance teams hours ' more so if they rely on email, spreadsheets, or paper-based processes. Many businesses turn to corporate credit card expense management software tools like Rho.

This practical guide is designed to help businesses evaluate the best options on the market and select the right company credit card expense management tool for their business needs.

What is corporate credit card expense management?

Corporate credit card expense management is how organizations track expenses against budgets, process all supporting documentation, migrate transaction data to the ERP to support financial reporting, and ensure expense policy compliance.

Corporate credit card expense management can be a tedious, time-intensive process, but automation tools can speed it up while improving financial controls over spending and boosting operational efficiency. Here is a more exhaustive list of the steps involved:

Next, well cover the top corporate credit card expense management platforms on the market today.

The 11 best corporate credit card expense management tools for CFOs

1. Rho

Rho is a comprehensive finance platform thousands of American middle-market businesses use to automate their CFO suite: payables, expenses, treasury, banking services, accounting, and more.

Rho Expenses gives finance teams the tools to easily manage Rho Card spending, process expense reimbursements, and automate expense management.

Features

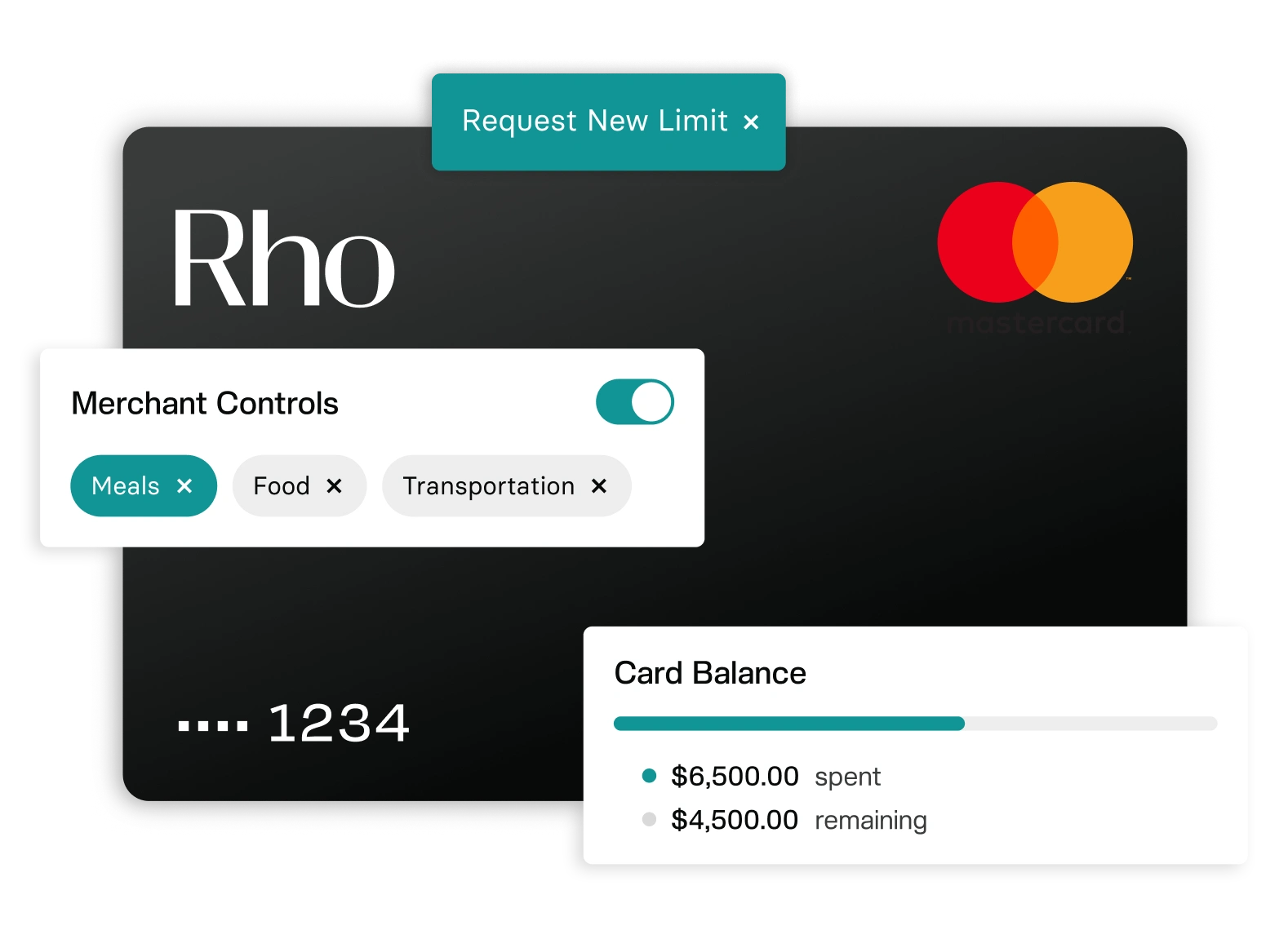

Starting with the Rho Card, Rho allows businesses to create unlimited virtual and physical corporate cards and assign strict spend controls to each, including limits, merchant and category controls, and more."We want to focus on the brands growth, not manual processes. Rho is instrumental in this. It has everything we need, and the automation will allow us to scale to a 100-person team without spending much more time on banking or expense management."—Craig Bartlett, Director of Finance & Strategy at Munk PackIn the Rho platform, admins can also generate customizable spending rules that create automated approval workflows based on the level of spend and budgets involved. When a Rho Card is used, employees receive notifications via SMS or the Rho mobile app to upload their receipts and other transaction data synced to the platform.

All transactions then sync live into Rho and can be sent to your ERP in seconds, eliminating data entry, thanks to our native integrations.

Pros

End-to-end finance: Rho offers expense management and other capabilities like AP, banking services, treasury, and corporate cards all in one platform.

Holistic spend management: With T&E expenses and AP automation in one platform, organizations using Rho get a full picture of spending.

Free service: The Rho platform is free to use.

Robust multi-entity capabilities: Rho is designed for scale, from 10-person growth-stage startups and 200-plus employee, multi-entity businesses.

Customer support: Available 24/7 to assist with implementation and questions.

Cons

Straight cashback vs. points: Some companies prefer legacy corporate card solutions like Amex or Capital One for the point rewards they offer, even if that impacts process speed.

Integrations

Rho integrates with Quick Books Online, Oracle Net Suite, Microsoft Dynamics 365 Business Central, and Sage Intacct.Rho also supports flat-file CSV exporting, so you can automatically tailor transaction categorization to your business needs. Read more about our accounting integrations here.

Pricing & Fees

The Rho platform is free, with no fees for users, payments, accounts, or the overall platform.

The Platinum advantage

With Rho Platinum, were providing even more value to our customers without gating the benefits behind additional fees or tiers. Heres what you can look forward to with Rho Platinum:

Competitive cashback: Customers can earn 2% cashback1 on up to $1m/year of spend to help scale faster and reinvest in what matters most to them.

Premium benefits and perks: Businesses on Rho Platinum can access over $1 millionin total perks. From private, invite-only receptions to premium seats at upcoming sporting events, businesses can unlock access to exclusive events alongside well-connected founders and influential investors across New York and San Francisco. To help with day-to-day operations, theyll also get over $600K+ in rewards for tools like Perplexity Enterprise, Google Cloud, and AWS, among many more.

Award-winning support: Customers can access live, 24/7 support from real humans, ensuring they get the help they need when they need it. Implementation support is also available to help customers onboard onto the Rho platform and start earning rewards faster.

How to get started with Rho Platinum

Rho Platinum is available to new and existing customers. And with no minimum funding or deposit required, getting started is simple:

Use your Rho Checking account for day-to-day operational costs, such as marketing spend, Saa S licenses, office rent, etc.some text

Connect Rho to your payroll provider and use it for processing

Use Rho as your primary account for connecting revenue

Sign up for a Rho Corporate Card

Once youre set up, you can start earning 2% cashback on up to $1m/year of spend with 1-day cards or 1.75% cashback on 30-day cards. Plus, youll gain access to millions of dollars in exclusive events, and around-the-clock, live customer support.

Existing customers who want to take advantage of this offer can contact their account manager to get started.

2. Navan

Navan is a popular travel management and expense platform alternative to SAP Concur, thanks to its strong, user-friendly UI, ability to adapt to your corporate card solution, and built-in travel booking capabilities.

Features

Navans platform automates transactions processed with Visa and Mastercard or using a Navan corporate card or your corporate card. Set up automated spending controls with the ability to change spending limits. Virtual cards can be integrated with each travel booking. The Navan Rewards program rewards employees for reducing travel costs.

Here are some additional benefits:

Receipt submission: Users can take a photo of a receipt after making a payment, and the software automatically posts the related expense.

Notifications: Cardholders receive a notice to upload a receipt immediately after each purchase.

Incentives: Cardholders see incentives offerings for selecting flights and hotels when they book travel using Navan.

Integrations

Navan offers accounting integrations with Quick Books, Net Suite, Xero, and more.

Pricing

Expense management, which includes corporate cards, is free for a companys first 50 monthly active users. Navan requires you to book a sales call to get a specific quote for businesses with more than 50 monthly active users.

Why Navan + Rho

Did you know that Rho and Navan work well together? Pair Rhos corporate card, banking, AP automation, and treasury with Navans best-in-class expense management and travel booking platform. Learn more today.

3. SAP Concur

SAP Concur is a travel & expense management platform companies use to manage travel booking and employee expenses. Concur Expense provides automated expense management with customized workflows, approvals, and reports. Concur Expense It links in credit card activity.

Features

The Concur Expense It platform automatically matches uploaded receipts to card charges. Expense It reconciles credit card charges to posted expenses, speeding up account reconciliations and the month-end close. Users can use the desktop or mobile functionality.Managers can customize workflows and spending policies; the platforms automation will follow the guidelines. Users can search for flights, car rentals, and hotel availability using Expense It and review loyalty point balances.

Managers can also review real-time reports, storing all data and communications in one place. SAP Concur provides integrations with ERPs, accounting systems, and payment providers.

Pros

Compliance: Some finance teams use SAP Concur because of its capabilities to help enforce expense policy compliance.

Brand recognition: SAP has been around for several decades as a brand that many Fortune 500 companies trust.

Cons

UX: SAP Concur has a reputation for having a clunky user interface. According to reviews, the platform sometimes freezes, and the interface is difficult to navigate.

Expensive: SAP Concur is enterprise-grade expense reporting software that typically has expensive contract fees.

Receipt uploading: Some reviewers point out that uploading receipts is difficult, and users cannot upload receipts in batches.

Integrations

SAP Concur integrates with SAPs ERP SAP S/4HANA, Oracle Net Suite, Quick Books, Xero, and other ERPs.

Pricing & Fees

SAP Concur requires you to book a sales call for a specific quote.

SAP Concur vs. Rho

SAP Concur has been a de facto travel & expense platform for decades but has limited expense management capabilities. The interface seems old and difficult to navigate. Uploading receipts is time-consuming, and users need help to upload receipts in batches.

Concur Expense has limitations that make it difficult to process more card transactions as the company scales. Rho provides a platform that allows businesses to scale.

Lastly, SAP Concurs UX and expensive fees have led many companies to move to more modern solutions like Rho, which has the added benefit of having built-in AP, banking, and treasury.

4. Expensify

Expensify provides expense management software allowing employees to track and submit expenses for processing. The platform automates expense approval and processes employee reimbursements. Expensify Card manages credit card transactions within the platform.

Features

Expensify Card imports and accounts for company expenses. The software generates an e Receipt for most card transactions, eliminating the need to scan receipts. Expensify performs real-time reviews of transactions and spending policies to detect fraudulent transactions.

Users earn 1% cashback on each transaction, and Expensify offers perks and discounts through 20+ partners. The platform integrates with several accounting software packages.

Pros

Reimbursement process: Straightforward process with the ability to reimburse using direct deposit.

Mobile app: Using the app is intuitive and easy to navigate.

Reports tool: Reports can be created and easily shared with other people.

Cons

Receipt processing: Users need help scanning and uploading receipts on mobile and desktop. OCR does not always work well, and incorrect details are often picked up from receipts.

Product promotions: Several reviewers received too many inquiries promoting additional products. Too many pop-ups and notifications.

Billing practices: Several reviewers noted that the billing process could be clearer. Some believed that they were charged incorrectly after canceling Expensify.

Customer support: Many reviewers pointed out a lack of support and that issues were left unresolved for weeks or months.

Integrations

Expensify integrates with Quick Books, Net Suite, Xero, Sage, and other accounting platforms.

Pricing

Expensify offers three pricing plans for businesses. If less than 50% of company spend is on the Expensify card, businesses pay a fee based on the amount of card use. Expensify requires you to book a sales call to get a specific quote based on your expected card use.

Expensify vs. Rho

Expensifys UX frustrates users, and several reviewers noted a lack of follow-up on customer support issues. The platform has a confusing price structure that some believe is too expensive. Users receive too many inquiries promoting other products.

Rhos users enjoy frictionless spend management using the Rho Card. Rhos software captures receipts in real time, and the approval process is fully automated. You can create custom spending rules based on your workflow needs. Rho does not charge platform fees.

5. Brex

Brex provides corporate cards, expense management, travel, and bill pay software solutions. The platform offers real-time expense tracking and variance reporting. Brexs customers can do business in several different currencies.

Features

Brex corporate cards can be issued digitally or in physical form. Spending limits can be set by dollar amount or vendor, and cards can be used for recurring payments. Brex can also pay reimbursements using the employees local currency.

Brex automates document collection, and users can set up approval workflows. The platform speeds up the month-end close using automation. Finally, the card offers cashback rewards, and the Exclusive Rewards program pays higher rewards for more card use.

Pros

Mobile functionality: Users can easily take photos of receipts and upload them for expense coding with the mobile app.

Brex corporate card: The corporate card streamlines expense processing, and receipts can be easily posted as card expenses.

Reimbursements: Brex makes employee reimbursements easier to process.

Cons

Customer support: Several reviews point out that customer support needs to be more responsive.

Balance reporting: Some reviewers feel that they need better reporting on Brex card available balances.

Bank transfers: Brex needs to process bank transfers faster, according to some reviewers.

Integrations

Brex provides ERP integrations with Net Suite, Xero, Sage, and Quick Books.

Pricing

Brex requires you to book a sales call to get a specific quote.

Brex vs. Rho

Brex has a complicated card rewards structure based on payment frequency and card use. By comparison, Rho offers up to 2% cashback through Rho Platinum.

While Brex largely targets VC-backed startups, Rhos expense management solution is purpose-built to scale with both growth-stage startups and middle-market companies.

Several Brex users report problems with access to customer service. Rho, on the other hand, provides live expert service 24/7. Brex charges fees for its expense management platform, and the Rho platform is free.

6. BILL Spend & Expense (formerly Divvy)

Following BILLs announced acquisition of Divvy, BILL rebranded the Divvy credit card and expense management platform as BILL Spend & Expense. The company provides the BILL Divvy credit card, an AP automation solution, and accounts receivable software.

Features

When spenders swipe a card, it only takes a few taps for expenses to be fully coded and ready to sync with your accounting system, speeding up the month-end close. The platform categorizes spend in real-time, and managers are notified when spending occurs.

The BILL Divvy credit card offers rewards based on the type of credit card spending, and how frequently the balance is paid (weekly, twice a month, or monthly). Businesses must spend at least 30% of the credit limit each month to qualify for rewards.BILL has other restrictions that impact the ability to earn rewards. If you miss a payment, close your account within the first year, or spend less than $5, 000 in each of the last three months of your first year, you lose all reward points. The value of each point may also change.

Pros

User experience: Users comment that the app is easy to use and to navigate.

Receipt collection: Collecting receipts and coding them into the platform is a smooth process.

Budgeting: The platform codes expenses to the correct budgets, and the budgets are linked to the proper general ledger accounts.

Cons

Quick Books integration: Several reviewers mention problems with the Quick Books integration. Syncing reimbursements and other transactions can be difficult.

Customer support: Some Divvy customers feel that the quality of customer service has sharply declined after the purchase by BILL.

Reporting: The platform needs to provide more reporting customization. Some reviewers want reports that drill down into shorter periods.

Integrations

Integrations with Sage, Oracle Net Suite, Microsoft Dynamics, and Quick Books. See the comments above regarding Quick Books integration issues.

Pricing

BILL Spend & Expense is free, but the companys AP automation has a cost. BILL requires you to book a sales call to get a specific quote for AP automation. Most businesses need an integrated version of both platforms to process expenses and AP efficiently.

BILL Spend and Expense vs. Rho

The BILL Spend and Expense has a complicated process for earning corporate card points and rewards. Rho offers a more straightforward cashback reward and integrations with accounts payable, commercial banking, and treasury management functionality.

BILL Spend and Expense gets mixed reviews on customer support performance. Some reviewers believe that customer support during initial setup is effective, but that resolving issues after installation is difficult. Rho has a consistently responsive customer service team.

BILL Spend and Expense only offers budget-level controls. Rho provides card-level and user-level controls for more precise expense management.

7. Airbase

Airbase is a spend management platform for small businesses and middle-market companies. It combines comprehensive accounts payable, a corporate card program, and employee expense reimbursements into one system.

Features

Airbase users can take a receipt photo and upload the document using the mobile app. The software uses OCR technology to populate the expense details, including GL accounts, amounts, and vendors and automates approval workflows and spending limitations.

The Airbase card offers unlimited cashback on all spending categories, and cards can manage one-time and recurring payments. Card users receive automated fraud detection alerts, and Airbase has an integration with AMEX credit cards.

Pros

Workflows: Users can easily customize workflows.

ERP integrations: Effective integrations with Oracle Net Suite, Sage Intacct, and other software providers.

Ease of use from a user perspective and administrator perspective.

Cons

Expensive fees: Fees charged for reimbursements, bill payments, and custom Net Suite fields.

Performance: Both the desktop and mobile platforms sometimes freeze or dont load data on the first try, according to some reviewers.

Time lag before payments: According to some customer reviews, there is too much time between debiting the users bank account and paying funds to the vendor.

Integrations

Integrations with Net Suite, Sage Intacct, Quick Books Online, Quick Books Desktop, and Xero.

Pricing & Fees

Airbase offers Standard, Premium, and Enterprise pricing levels. Airbase requires you to book a sales call to get a specific quote.

Airbase vs. Rho

Rho provides a frictionless platform for card use, while Airbase has occasional issues with software performance. Airbase follows a subscription-based software fee model so that costs can add up, whereas the Rho platform is free.

Airbase is an effective expense management and procurement system but lacks the more robust banking and treasury features in the Rho platform.

8. Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one platform. The company also offers a business bank account.

Features

Volopay corporate cards provide customized, pre-approved spending limits. Expenses are automatically categorized when spending occurs. Managers can issue virtual or physical cards and receive real-time tracking of all card transactions. Cardholders submit expenses using the mobile app.

Pros

UX interface is user-friendly and easy to navigate.

Receipt scanning: Simple to process using Volopay.

Recurring payments: Easy process toset up recurring payments.

Cons

Customer support issues: Multiple reviewers noted problems reaching customer support and getting issues resolved.

Xero integration: Users must manually enter data before invoices can be posted into Xeros integration, according to several users.

Mobile access: Several users pointed out that the login process for mobile isnt efficient.

Integrations

Integrations with Xero and Quick Books Online.

Pricing & Fees

Volopay requires you to book a sales call to get a specific quote.

Volopay vs. Rho

Volopays corporate card functionality is not consistently seamless for users. Customers must manually input expense data in some cases, and logging into the mobile app is cumbersome. Volopays software may freeze during data uploads, and users must start over.

Rho offers a frictionless spend management process with the Rho card. Volopay charges fees for the platform, and Rho does not charge platform fees.

9. Pleo

Pleo offers automated expense management. Users can manage company card expenses, employee reimbursements, mileage reimbursement tracking, subscriptions, and invoices using Pleo. Note that Pleo is not available in the US.

Features

Pleo corporate cards allow users to set up approval workflows and spending limits by dollar amount or by vendor. The cards automatically capture receipts, and users can set up recurring payments. Managers can cancel cards at any time, and cardholders earn up to 1% cashback.

Pleo provides real-time reporting of expenses for manager review.

Pros

Employee reimbursements: The software speeds up reimbursements and handles mileage expenses.

Spending controls: Controls are effective, and management receives timely reports

Mobile app: Users like the mobile app and the ability to easily upload receipts.

Cons

High costs: Several reviewers feel that the cost is too high and are hesitant to pay more for additional features.

Fee confusion: Some users were confused about charges and felt that Pleo didnt communicate effectively on fees.

Low balance notifications: Pleo should provide more balance notifications, according to some reviewers.

Integrations

Pleo has integrations with Quick Books, Sage, and Xero.

Pricing

Pleo has a free Starter level plan and an Essential plan that starts at 39 pounds per month (~$47US dollars). The Advanced plan starts at 79 pounds per month (~$95 US dollars). All three plans allow up to three users. Pleo requires you to book a sales call to get a specific quote for more than three users.

Pleo vs. Rho

Pleo is not available in the US market, while Rho serves the needs of US firms. Some users believe that Pleo is too expensive and the Rho platform is free.

10. Spendesk

Spendesk provides corporate cards and manages expenses, invoices, accounting automation, and budgeting. The company offers real-time reporting and several ERP integrations. Note that Spendesk does not serve businesses in the US.

Features

Businesses can issue corporate cards with built-in, adjustable spending controls. The software captures receipts and automatically posts expenses to the correct GL accounts. Managers can set up cards for single-use or recurring expenses, and track spending in real time.

Users can issue virtual or physical cards, and cards can be paused, updated, or canceled at any time.

Pros

The platform is intuitive: Users can easily navigate the platform.

Receipt uploads: Customers can take a photo of a receipt and quickly upload it to the platform.

Receipt emails: Receipts can be attached to emails or forwarded to a specific address.

Cons

Approval delays: Some users note that approved spending needs to be updated as approved in all cases. Approved spending may stay in review status in error.

Recurring expenses: Several users explained that they must enter monthly data for the recurring expenses. Recurring expenses are not fully automated.

High cost: Spendesk is expensive, according to several reviewers.

Integrations

Spendesk provides integrations with Quick Books, Xero, and Net Suite.

Pricing

Spendesk requires you to book a sales call to get a specific quote.

Spendesk vs. Rho

With Spendesk, users point out approval delays, problems with virtual card functionality, and recurring expenses that need to be fully automated. Rho offers a frictionless expense management process that allows a business to scale.Spendesk is expensive, according to several reviewers, and Rho is free. Rho also provides cash management and treasury services that Spendesk does not offer.

11. Fyle

Fyle offers an expense management platform that is integrated with corporate cards. The firm has integrations with Visa, Mastercard, and AMEX credit cards. Fyle does not provide an AP automation solution.

Features

Cardholders can submit expense receipts using the Fyle mobile app. The software scans data and matches the credit card transaction to the proper receipt, then codes the data to general ledger accounts. Fyle can manage expenses and employee reimbursements and provides real-time analytics.

Pros

UX interface: User friendly interface.

Receipt scanning: Quick and efficient process for scanning.

Employee reimbursements: Corporate cards and software make employee reimbursements easier.

Cons

Customer support: Some reviewers pointed out that customer is slow to respond, and that it takes too long to resolve issues.

Xero integration: Moving data from Fyle to Xero requires too much manual input, according to several reviewers.

Software reliability: Both the mobile and desktop versions sometimes freeze when expenses and other data are posted into the platform.

Integrations

Fyle has integrations with Quick Books Online, Net Suite, Sage Intacct, and Xero.

Pricing

Like Zoho Expense, Fyle offers Standard, Business, and Enterprise pricing plans. Pricing depends on the number of users per month, and other factors. Fyle requires you to book a sales call to get a specific quote.

Fyle vs. Rho

Fyles corporate card platform requires too much manual input and sometimes freezes during use. The Fyle integration with Xero requires more manual input than most expense management integrations.

Fyle does not provide an AP automation solution, and users must purchase other software tools to manage spend.

Rho provides a frictionless and reliable expense management solution with corporate cards. Rho customers can handle expense management, corporate cards, commercial banking, and accounts receivable on a single platform, and it is free to use.

Does a corporate credit card make expense management easier?

It can, but this depends on the type of corporate credit card you are using. Some corporate cards make expense management easier, but others do not.

Legacy corporate card providers arent technology companies; they lack the technology-driven features that newer technology companies like Rho offer. Some common signs your corporate card is making expense management harder includes:

You have to wait until a credit card statement is issued to begin the reconciliation process.

On any given day, you are unsure how expenses are mapped to specific budgets and lack visibility over your employee spending until the month-end close process.

Your employees are submitting receipts late and the number of out-of-compliant expenses increases.

Your financial reporting process is painful and susceptible to errors.

You find that your teams are frequently overspending and fraud-related issues are occurring more frequently.

When you use corporate cards that are backed by an integrated expense management platform, managers can solve these headaches and take full control of company spend with complete visibility in real-time.

Benefits include:

Better expense tracking, margin control, and cash flow management.

Reduction in overspending, expense policy non-compliance, and fraud-related charges.

Employee cardholders submit expense receipts faster thanks to smart notifications and ease of uploading.

Faster month-end close by transforming credit card transaction reconciliation from a post-close activity to a pre-close checklist item.

Easier reimbursement management and tax preparation with clear audit trails.

Your team is focusing on higher impact, engaging work.

What are the risks of corporate credit cards?

Without automation and proper controls, using corporate credit cards may lead to unapproved spending and generate accounting errors.

Paying for unapproved transactions

The business is liable for paying corporate credit card balances, and controls must be in place to minimize unapproved transactions.

These situations increase the risk:

Delays in review: Management does not review transactions as they occur.

Receipt submissions: Cardholders are not immediately alerted to submit receipts after using the card, and AP does not follow up quickly to get missing receipts.

Late or missed approvals: Approvers are not notified when a transaction needs to be reviewed, and AP does not follow up on missing approvals.

If credit card management isnt automated, many transactions may not be reviewed until the credit card statement is received. Even worse, a company with poor controls may approve a fraudulent credit card transaction payment.

Allocating expenses incorrectly

When credit card transactions arent posted to the correct expense accounts, the financial statements are incorrect, and management cant assess budget performance or profitability. Here are several factors that contribute to the problem:

Workflows: Workflows are poorly designed or not properly communicated to the accounting staff.

Coding: Manual expense coding generates frequent errors.

Budget management: Managers dont approve and implement a budget before the beginning of the fiscal year, or budgeting vs. actual spending (variance analysis) isnt performed each month.

If a business has a CPA firm perform an annual audit, the expense allocation problem will likely be identified. However, the accounting department may spend much time posting and adjusting journal entries to the correct general ledger.

What to look for in a corporate credit card expense management tool

Find a corporate credit card tool that fully embraces automation to speed up processing and increase accuracy. The platform should automate controls over credit limits and spending decisions. Users should be able to upload receipts and post expenses to GL automatically.

Approvals should be automated, along with account reconciliations at month end. The best platforms are reliable, and offer ERP integrations. Finally, use a credit card management system that is also integrated with an AP automation tool.

What aresome best practices for credit card expense management?

Follow these best practices to maintain an effective credit card expense process:

Eliminate employee reimbursements

The right corporate credit card expense management system can help you put in place clear controls that eliminate the need to process expenses via reimbursements, which can require more attention and documentation. You unlock the ability to earn cashback and streamline your finance operations while improving your expense policy compliance and fraud prevention.

Implement a spending policy

Create and communicate a spending policy for your entire organization. The entire staff should be able to quickly access an electronic version of the policy. Use the policy to set credit limits on cards, and to dictate the type of spending allowed on each card.Make cardholders responsible for quickly responding to notifications to submit receipts for spending.

Create and monitor budgets

Require managers to submit budgets and ensure that each budget is approved before the start of the next fiscal year. All spending (including credit card expenses) must be assigned to a line item in a budget.These best practices protect your business from overspending and will alert managers to potentially fraudulent transactions. As mentioned above, use a corporate card expense management platform that is fully automated.

Wrap-up: Choose the best corporate credit card expense management software

After reviewing the different credit card expense management software solutions on the market, think about the features and tools that are most important for your business.

And if you still need help choosing the corporate card expense management software, let's make this easy.

If:

End-to-end functionality to capture, record, approve, and pay expenses

Full integration with corporate cards for easier expense management

A scalable platform that grows as you grow

All wrapped up in unbeatable pricing and 24/7 customer support sounds nice to you, then you should consider Rho.

Schedule time with a Rho payments expert today to open a Rho account today.

FAQ: Corporate credit card expense management

What is a corporate credit card?

A corporate credit card helps companies manage their business expenses and budgets. Its often used for expenses like travel, digital ads, client entertainment, cloud computing, Saa S software subscriptions, and more.However, corporate credit cards on the market vary widely. Some offer better cashback or points while others incorporate technology more than their peers. For example, a Capital One or Chase card is what-you-see-is-what-you-get; you pay for expenses and receive a monthly statement.Newer technology companies like Rho have introduced smart corporate credit cards that provide additional capabilities including:

Spend controls you can configure to enforce your expense policy before a card is swiped.

Automated approval workflows that handle all expense approvals for you.

A real-time data feed between your corporate credit card expense management platform and your ERP, making it easier to close the books.

Real-time spend visibility via smart budgeting tools.

How to create a corporate credit card expense policy?

We developed a full guide to help you with this!

What is corporate expense management?

Expense management is a systematic approach businesses employ to track, analyze, and control employee-initiated spending related to day-to-day company operations.

How do I manage my business credit card receipts?

Weve written a guide providing some receipt management best practices you can read here!Whether you're a business owner or a finance team looking to boost efficiency and cut costs, the Rho platform and Rho Mobile App can help you create a digital receipt filing system that simplifies your expense management process.

How do I monitor my credit card expenses?

Most corporate credit card providers offer online tools where you can quickly see credit card transactions.Rho offers expense reporting, automated notifications, and budget tools that provide finance teams with real-time visibility over credit card expenses and how they impact your spending in real-time.

Competitive data was collected as of January 28, 2025 and is subject to change or update.Rho is a fintech company, not a bank or an FDIC-insured depository institution. Checking account and card services provided by Webster Bank N.A., member FDIC. Savings account services provided by American Deposit Management Co. and its partner banks. International and foreign currency payments services are provided by Wise US Inc. FDIC deposit insurance coverage is available only to protect you against the failure of an FDIC-insured bank that holds your deposits and subject to FDIC limitations and requirements. It does not protect you against the failure of Rho or other third party. Products and services offered through the Rho platform are subject to approval.The Rho Corporate Cards are issued by Webster Bank N.A., member FDIC pursuant to a license from Mastercard, subject to approval.1Up to 2% cashback; terms and conditions apply. See eligibility and complete Rho Cashback Rewards Program terms and conditions here.