How we enhanced Rho Expense Management

New approval flows, notifications, and UX updates to automate and streamline your expense management.

Since we launched the capability last year, Rho Expense Management has helped businesses like Best Bay Logistics and Inno Mark Communications control spending and save thousands of operational hours.

Today, I'm excited to share how we're improving the Rho expense management experience with advanced functionality and simpler designs based on customer feedback.

Improvement #1: Multi-tiered approval workflows

Feature spotlight:Multi-tiered approval workflows

Previous user experience

Previously, you could configure approval workflows to assign a single expense approver based on dollar thresholds. For example, expenses above $100 require your manager Jason's approval, and those above $250 require the CFO Michelle's approval.

What we learned

Customers want even more customizability and dynamic controls, as expense policies can be complex.

If an expense is minor, you may only need a single approver, but the reality is that many businesses want more controls and more eyes on money going out of the door. For those higher-expense items, having only one layer of approvals is not ideal.

New Rho experience

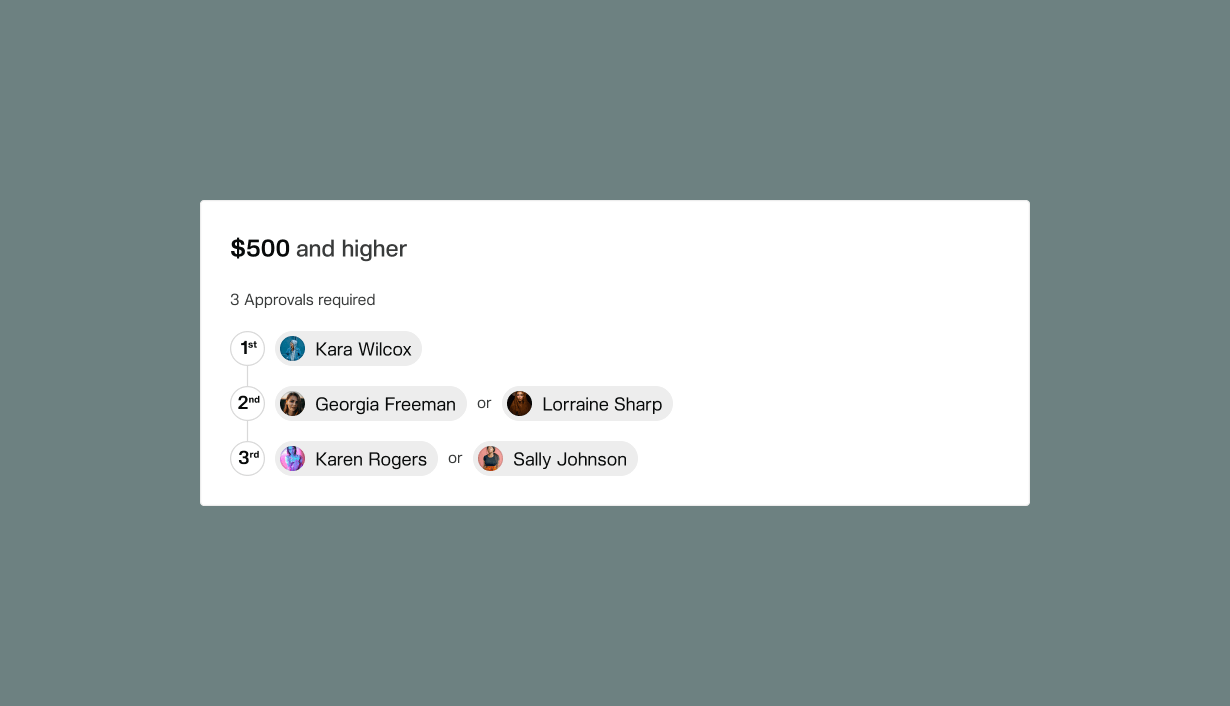

Now, clients can create multi-tiered approval workflows.

Using the previous example, you can still configure expenses above $100 to require Jason's approval. However, for expenses above $250, you can establish a multi-step approval sequence where Jason first approves before the expense is sent to Michelle for final sign-off.

In the previous experience, Jason wouldn't have been part of the $250 expense approval sequence.

This experience is optimal for businesses in the 10-50 employee range with a central approver for expenses (like a CFO) but also want to incorporate a first level of approvals for additional control.

But what about organizations with employee counts that are too large for a CFO to manage all expenses centrally?

Improvement #2: Skip-level manager approvals

Feature spotlight: Skip-level manager approvals

'Prior user experience

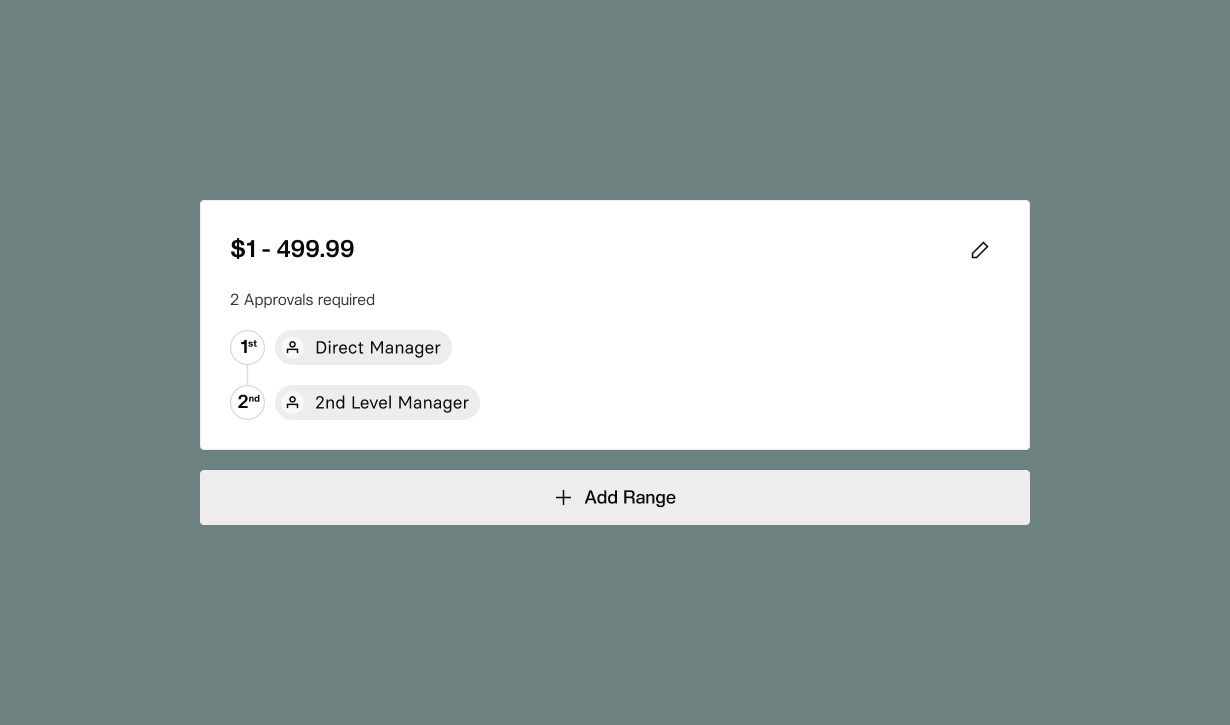

Businesses with larger employee bases ' where expenses are harder to manage centrally ' could only create approval workflows in Rho at the direct-manager level.

What we learned

Some clients with larger employees wanted the ability to incorporate multi-level approval workflows that aligned with their org chart by also accounting for skip-level manager approvals.

New Rho experience

Rho customers can now configure skip-level manager approvals. For example, you can configure expenses above a certain threshold to require an employee's direct manager to approve the expense before sending it to the skip-level manager for final approval.

Improvement #3: New ways to onboard Rho users

Feature spotlight:New ways to onboard Rho users

Prior user experience

To add users to Rho, you could do so three ways:

Invite individual users in the User Management tab.

Bulk upload users via CSV in the User Management tab.

Connect Rho to your HR software using our new HR integrations and sync this information in real time.

What we learned

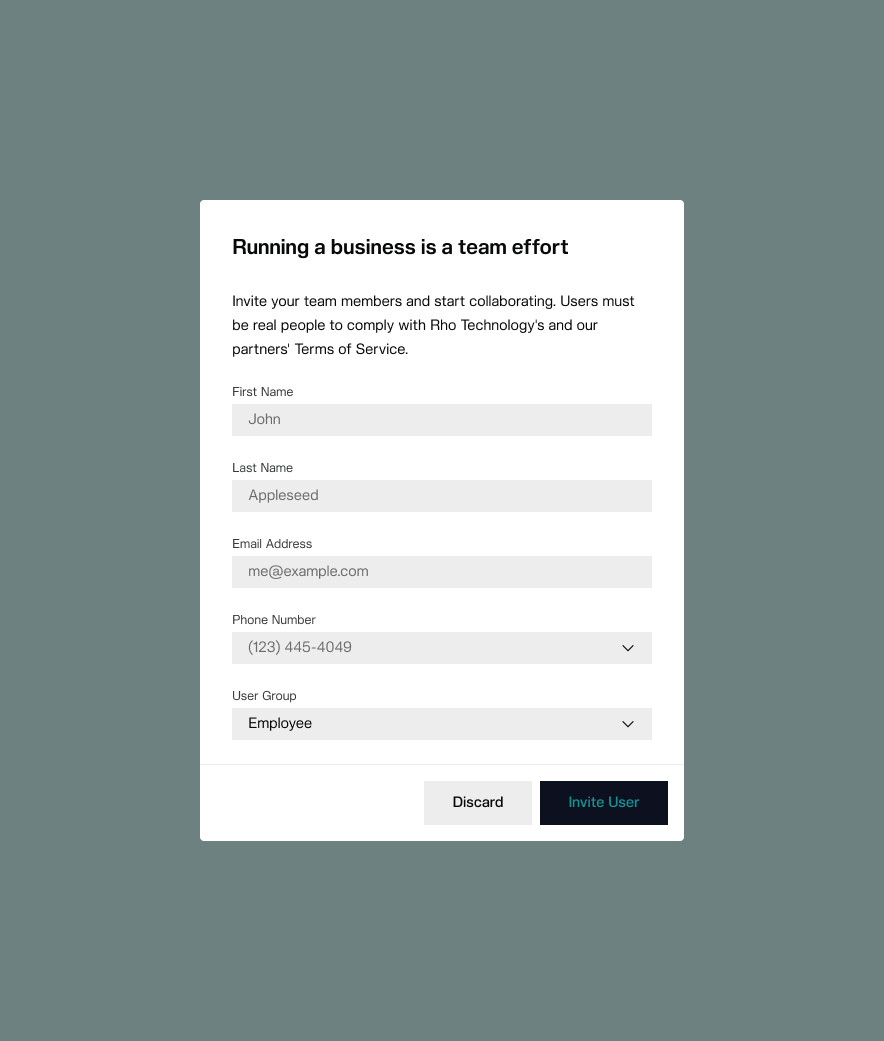

As users began configuring approval workflows, there may be cases where they haven't invited a specific approver to Rho. They would have to leave the expense workflow configuration menu and use one of the three methods above.

New Rho experience

Admins can now invite users to the platform directly from the approval routing modal, offering another option that helps them save time.

Improvement #4: Unlock better transparency on approval statuses

Feature spotlight:New approval status in Expense pop-up drawer

Prior user experience

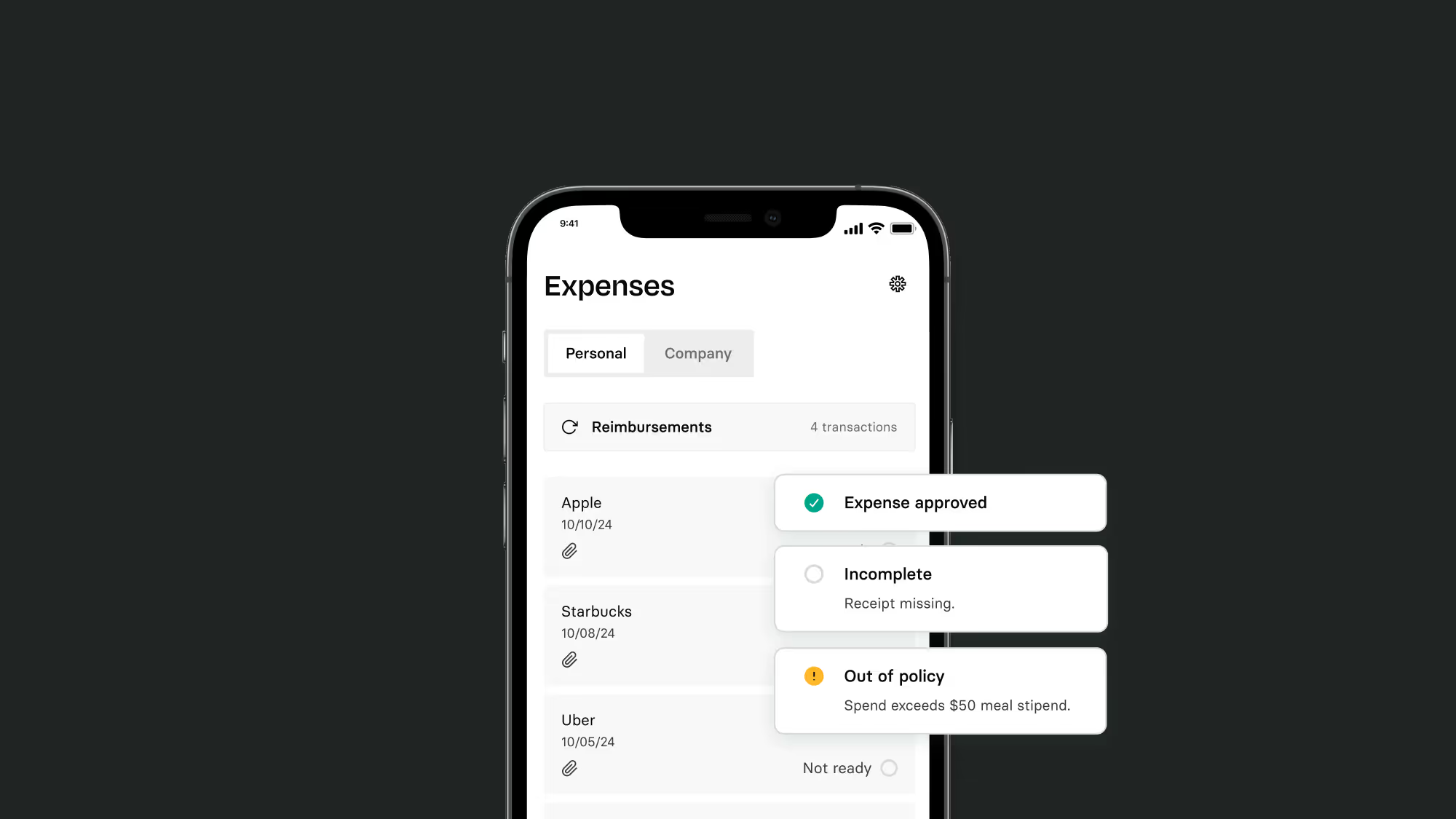

Once Rho Card users submit expense receipts, the Expenses view of the Rho platform will then show approval statuses for each corporate card transaction. With labeling, you could see which business expenses needed review and which were completely processed.

What we learned

While you could see which expenses were awaiting approval, it wasn't always clear to users who exactly needed to approve a certain expense.

If approvals are getting stuck, it might be frustrating for employees to submit their expenses or reimbursement requests. Finance teams experiencing delays due to approval bottlenecks would also be impacted.

How we improved Rho

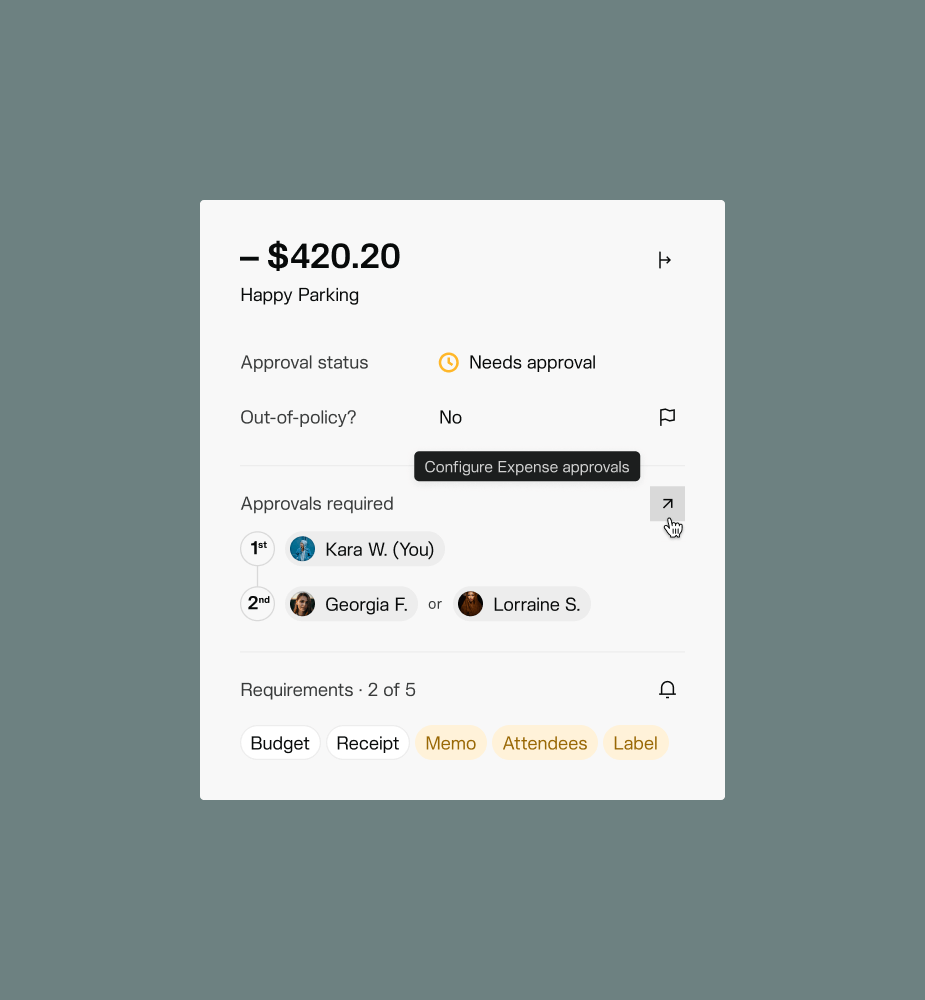

We updated the Expense pop-up window that appears when you click a specific expense to more clearly display what stage of the approval workflow the expense is currently in.

No more bottlenecks!

Save time with Rho, one receipt at a time

The way that one company prefers to structure its approval process can be very different from the next company's process. Every company is different. Behind the businesses that run on Rho are individuals with individual preferences of what makes the most sense for them and preferred orders.While we are committed to shipping fast, we are equally invested in making improvements to respond to your feedback. Do you have a Rho feature idea you'd like to see ' or an improvement you want in a future release? Please let us know!

Tired of spending hours processing expense reports? Join the growing list of finance teams using Rho to make finance frictionless today and get in touch!

FAQs: Expense management

What is expense management?

Expense management is a systematic approach businesses use to track expenses and analyze and control spending that supports day-to-day company operations. Some companies pay for expenses using company corporate credit cards or prefer employees to pay and submit reimbursement requests.With either method, expense management involves monitoring transactions, navigating approvals, setting clear policies, budgeting, ensuring compliance, executing transaction data entry, and recording journal entries supporting month-end close.

What is expense management software?

Expense management software automates businesses' tasks to adequately pay for goods and services, track and control costs, and account for purchases during bookkeeping events like month-end close.

Corporate credit card expense management software can augment your business's T&Eand month end close processes while delivering a delightful user experience. For example, the right expense management system can save your finance team (and other employees) hours each month not having to manage manual transaction reconciliation and limit non-compliant spending that otherwise hurts your margins. That's one reason why it's understandable that PWC reports that 53% of CFOs plan to accelerate digital transformation using data analytics, AI, automation, and cloud solutions. Well-managed businesses take advantage of automation vs. over relying on time-consuming, manual expense processes and spreadsheets.

Why should I consider automating my expense management?

Automating your expense management is an easy way to save time, reduce errors, provide real-time visibility into spending, and allow for easier audit and compliance checks.

The best expense management tools on the market today automate these essential financial workflows (like expense tracking) and provide transparency into company-wide transactions—eliminating the need for traditional expense reports, paper receipts, and heavy workloads.

Rho's platform, for instance, offers broad visibility into spending as it happens, smart approval routing to avoid logjams, digital capture to instantly log and pair receipts, and customizable controls to eliminate expense policy violations—all accessible and configurable via a centralized dashboard.

It's designed to empower business leaders and finance teams to take control of their company spend and ensure employees can help them in a collaborative process that takes minutes—not days.

How do I know what expense management platform provider is right for my business?

Great question! We wrote an entire guide to help you find the right expense management solution for your business needs. In short, not all expense management Saa S is built the same.

What is an expense policy?

A company expense policy refers to guidelines regulating how a company spends its money, often focusing on travel, entertainment, and other reimbursable employee spending.An expense policy clearly outlines allowable types of employee expenses, guidelines for getting approvals and submitting expense reimbursements (if applicable), and expectations when the policy is violated.

Often, the policy lives in a static document stored somewhere in your HR system or a shared folder and is given to employees as part of their onboarding materials.

How much does Rho cost?

The Rho platform, including our spend management system capabilities, is free. Read more about our pricing here.

Does Rho connect to my accounting software and/or ERP?

Rho integrates with Quick Books Online, Oracle Net Suite, Microsoft Dynamics 365 Business Central, and Sage Intacct accounting systems.Rho also supports flat-file CSV exporting, so you can automatically tailor transaction categorization to your business needs. Read more about our intuitive accounting integrations here.

Can I process employee reimbursements with Rho?

Yes! With Rho, you can easily manage your employee reimbursement process without relying on payroll cycles. Read about our employee reimbursement capabilities here.

Does Rho have a mobile app?

Yes, read how our user-friendly mobile app helps companies manage material and travel expenses more easily here.