Pending transactions: How long do they really take?

Learn what causes pending transactions, how long they really take, and what you can do about delays.

Rho Editorial Team

Key takeaways:

Pending transactions typically clear within 1'5 business days but may take longer due to merchant batching, holidays, or security checks.

Manage pending transactions by using virtual cards, regularly checking account activity, and contacting merchants to resolve delays, ensuring smoother cash flow and expense tracking for businesses.

Ever checked your business account after a busy week and felt a moment of confusion seeing multiple charges labeled as 'pending'? Those mysterious pending transactions can make it challenging to understand exactly how much money your business truly has available.

In this guide, we'll talk about what pending transactions are, how long they typically last, and how to handle them better, so you can focus less on guessing and more on growing your business.

What exactly is a pending transaction?

Simply put, a pending transaction is a payment you've made that hasn't fully processed yet. Your bank or credit card provider temporarily sets aside these funds, showing them as "pending" until the merchant completes the transaction.

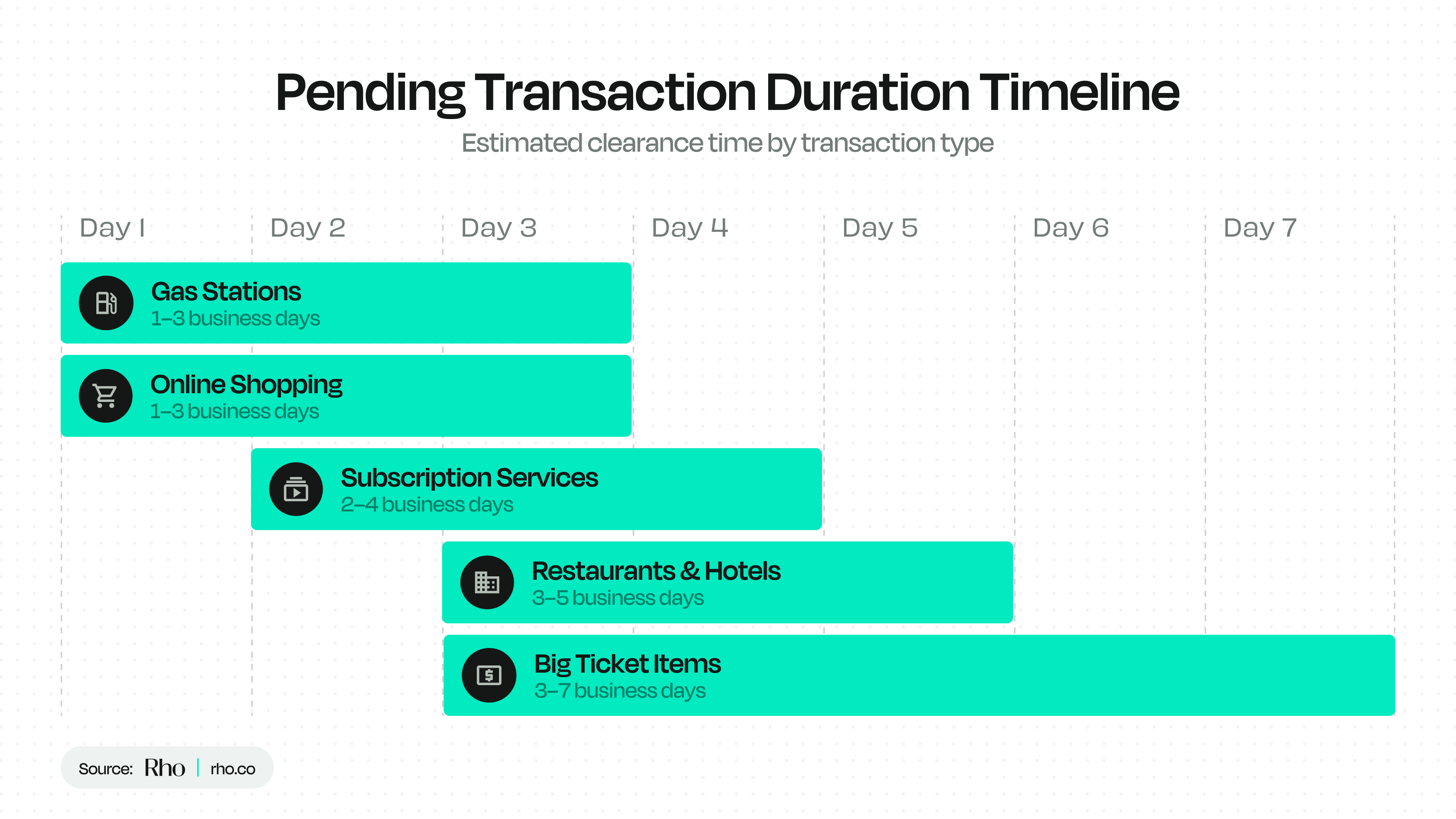

How long do pending transactions typically last?

Typically, pending transactions clear within 1'5 business days. But various factors can stretch this timeline a bit:

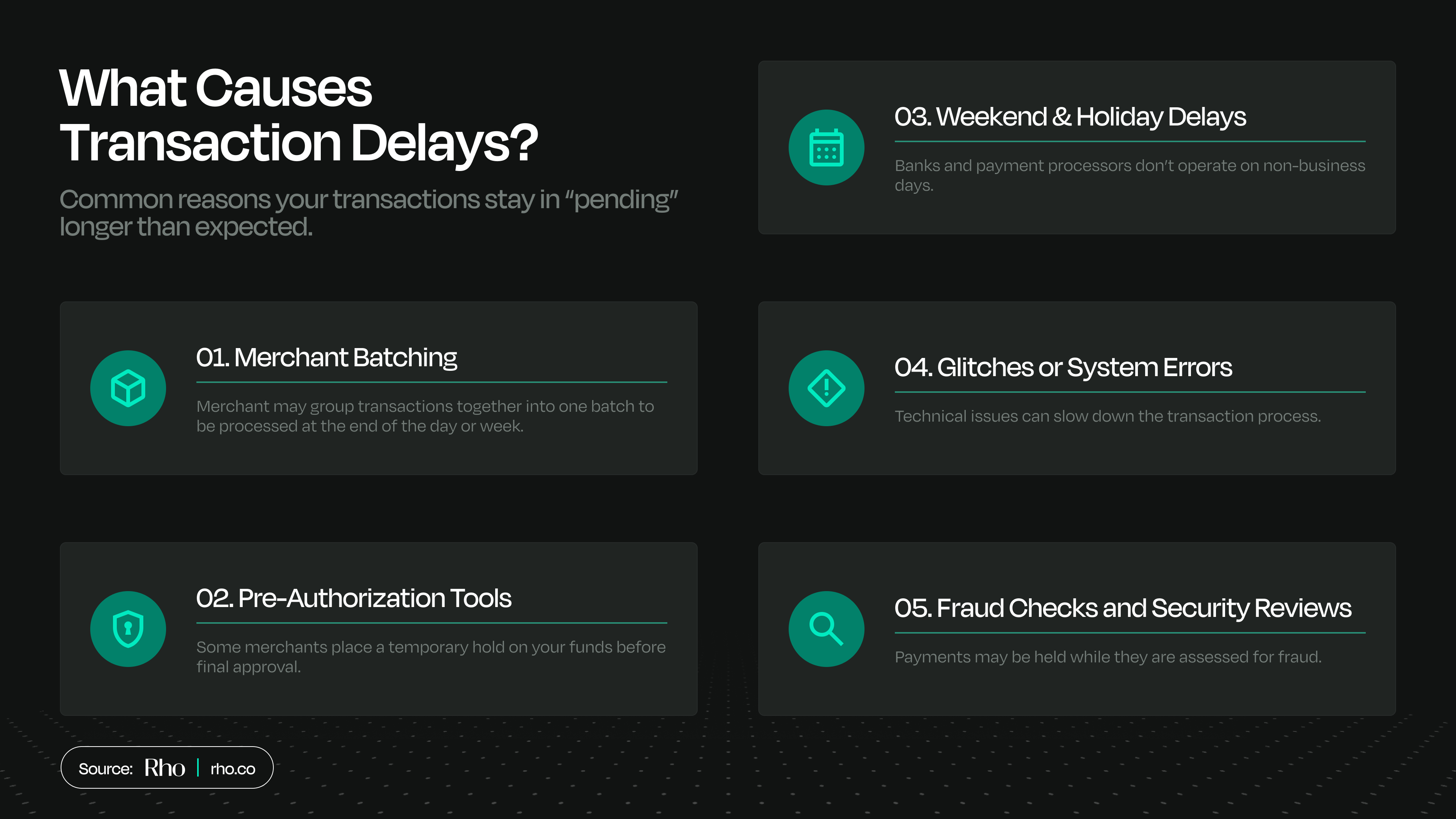

Why do pending transactions sometimes take forever?

We've all experienced that frustration of waiting for a seemingly straightforward transaction to finally clear. It can be especially troubling when you're trying to balance your books or plan future expenses.

So, why do these transactions hang around longer than you'd like? There are a few common reasons:

1) Merchant batching

Many merchants process their transactions in batches, rather than individually in real-time. This batching helps them save on processing fees and streamline operations, but it can significantly delay when your transaction officially posts.

Typically, merchants batch transactions at the end of the business day or even weekly, causing your transaction to remain pending until the batch is completed.

2) Pre-authorization holds

Certain businesses, notably hotels, rental car companies, and gas stations, commonly place pre-authorization holds on your account. These holds temporarily secure funds to ensure you have enough money available to cover the final amount.

For example, a hotel might place a hold larger than your actual room cost to cover potential extra charges, like room service or damages. These holds can last several days after you've checked out or returned a rental car, contributing to the pending status of the transaction.

3) Weekend and holiday delays

Financial institutions and payment processors typically operate only on standard business days, meaning transactions initiated on weekends or holidays won't start processing until the next business day.

So, if you make a purchase late Friday or during a long weekend, your transaction might sit in pending limbo longer than usual. Additionally, the merchant's batching schedule might compound these delays further.

4) Technical glitches and errors

Occasionally, technical issues can cause transactions to remain pending longer than expected. These glitches can happen on either the merchant's end or within banking networks.

When system outages, software updates, or data processing issues occur, pending transactions might be delayed significantly until the problem is resolved.

5) Fraud checks and security measures

Banks and payment processors sometimes hold transactions for longer periods to perform additional security checks, especially for large, unusual, or international payments. These fraud prevention measures, while necessary to protect consumers and businesses alike, can prolong transaction processing times.

What's the longest a transaction can stay pending?

Most pending charges clear within a week, but in rare cases, they can hang around for up to 30 days! If a merchant doesn't finalize the transaction within this timeframe, the hold usually drops off automatically.

What happens if a merchant never finalizes a pending transaction?

Good news—if a merchant doesn't process a pending charge, your funds will typically return to your account within 5'7 business days.

Banks generally give merchants up to 30 days to finalize transactions, after which your money is automatically restored.

How to manage pending transactions effectively

Here's what you can do to ensure pending transactions don't disrupt your business:

Use virtual cards: With services like Rho, you can use virtual cards tailored for specific expenses, giving you clear visibility and easier transaction tracking.

Check regularly: Make reviewing your account activity a regular habit—this helps quickly spot any irregularities.

Reach out to merchants: If a pending transaction feels stuck, a quick call or email to the merchant can often speed things up.

Can you cancel a pending transaction?

Usually, you can't directly cancel a pending transaction through your bank. Your best bet is to contact the merchant immediately, as they can reverse or cancel the charge if it hasn't been processed yet.

Do pending transactions affect your account balance?

Yes! Pending transactions immediately reduce your available credit or funds, even though they're not finalized yet. Keeping track of these charges is crucial for accurate financial planning.

Special considerations for business owners

Cash flow planning

Pending transactions can significantly affect your business's cash flow, especially if multiple large transactions are pending simultaneously. Keep this in mind during budgeting.

Expense tracking

Integrating a spend management platform (like Rho) can streamline your expense tracking and give you real-time insights, making pending transactions less disruptive.

Tips to speed up pending transactions

While you can't directly speed up processing, here are some proactive measures:

Avoid weekends/holidays for big expenses: Whenever possible, process larger or urgent payments during weekdays.

Confirm details at purchase: Ensure merchants have accurate payment details to avoid processing delays.

Communicate clearly with merchants: Promptly addressing any merchant inquiries can reduce transaction delays significantly.

Why choose Rho for your business transactions?

Working around pending transactions doesn't need to be complicated. With a clearer understanding and proactive strategies, your business can minimize disruptions and confidently manage cash flow. That's exactly where a platform like Rho comes into play.

Rho provides powerful financial tools specifically designed to simplify your business transactions.With features like virtual cards, real-time expense tracking, and insightful reporting, Rho makes managing your finances straightforward and transparent—freeing you to focus on what matters most: your business's growth.

Learn more about Rho and our pricing today