US Bank vs Chase: Which Is The Top Pick in 2025?

Compare US Bank and Chase on features, pricing, and user experience. See why Rho could be the superior choice for your business needs.

Rho Editorial Team

One key drawback of U.S. Bank is the significant reduction in interest rates on accounts without prior notification, which has cost customers hundreds of dollars in lost interest. For Chase, a notable issue is the lack of detailed feedback on customer reviews, making it difficult to gauge specific areas of concern.

Rho offers a more efficient solution for businesses by integrating AP automation and banking products with advanced software, streamlining financial operations.

Many businesses look to US Bank and Chase for their financial needs, but choosing the right solution can be a complex task. Both institutions offer a range of services that cater to different business requirements.

In this article, we'll review what each solution offers and how they compare, helping you make an informed decision. Additionally, we'll also explore Rho as a third option worth considering.

US Bank Overview

US Bank operates across several solution categories, including Personal Banking, Wealth Management, Business Banking, Corporate & Commercial Banking, and Institutional Banking. Their main value proposition lies in offering a broad spectrum of financial products and services tailored to individuals, businesses, and institutions, supported by strong online and mobile banking platforms.

US Bank Features

Some of the key features of US Bank include:

Checking and Savings Accounts: Various account types to meet different financial needs, including Bank Smartly Checking and Safe Debit accounts.

Credit Cards: Multiple credit card options with rewards programs, including cash back, travel rewards, and secured cards.

Investment Services: Automated investing, online investing, and personalized investment management.

Loans and Lines of Credit: Personal loans, home equity loans, and vehicle loans with calculators to estimate payments.

US Bank Pricing

US Bank offers a range of POS system plans with transparent pricing and no hidden fees:

Basic Point of Sale (talech Mobile): $0/mo, unlimited users, supports up to 100 products.

Entry Level Point of Sale (talech Terminal): $15/mo, one user per terminal, supports up to 100 products.

Essential Point of Sale (Starter): $29/mo, unlimited users, supports up to 500 products.

Full Feature Point of Sale (Standard): $69/mo, unlimited users, unlimited products, $99 setup fee.

Comprehensive Point of Sale (Premium): $99/mo, unlimited users, unlimited products, $99 setup fee, additional features.

The prices for each tier are not publicly listed.

Drawbacks To US Bank

General user reviews of US Bank are largely negative, with many customers expressing dissatisfaction with the bank's services.

"US Bank has dropped my Elite money market account APY from 5.0 to 3.25 (fed rate and inflation) and now suddenly to 1.0! Cost me hundreds of dollars in interest I need to live and pay bills." - DEE

"What a useless bank. They suddenly decided to charge me a monthly fee on my checking account (which had been a free account with a bank they absorbed)." - Rick Sock

For more detailed reviews, visit U.S. Bank Reviews.

Chase Overview

Chase focuses on business banking solutions, providing flexible options for banking, payment acceptance, and credit cards. Their main value proposition is to support businesses of all sizes, from personal and business customers to commercial enterprises, with local support and tailored financial services.

Chase Features

Some of the key features of Chase include:

Business Checking: Offers checking solutions tailored to various business sizes and industries, designed to meet business needs and support growth.

Payment Solutions: Provides a complete suite of merchant services to accept credit cards securely and conveniently, including point-of-sale systems, invoicing solutions, and payment gateways.

Business Credit Cards: Offers a range of business credit cards with rewards such as cash back, airline miles, or reward points, along with new cardmember bonus offers.

Chase Pricing

Chase offers a variety of business checking accounts, but specific pricing details are not publicly available.

Drawbacks To Chase

The overall consensus of Chase from the reviews is highly positive, with an all-time rating of 5/5 based on 6 reviews.

"Chase's customer service is exceptional, but I wish their mobile app was more intuitive and user-friendly." - Dan Wang

"The range of business solutions offered by Chase has significantly helped streamline our financial operations." - Myriam Rodrguez

For more detailed reviews, visit Chase Customer Reviews.

What to Know Before Picking US Bank or Chase

Looking at the reviews as a whole, businesses often face sudden changes in account terms and conditions with US Bank, which can disrupt financial planning. Additionally, poor customer service and unexpected fees are common pain points.

For Chase, while the reviews are generally positive, some users have noted that the mobile app could be more intuitive. This can be a significant drawback for businesses relying on seamless digital banking experiences.

Why Rho Is a Better Alternative

At Rho, we understand the frustrations businesses face with sudden account changes, poor customer service, and non-intuitive mobile apps. Our platform is designed to offer transparent terms, exceptional support, and a seamless digital experience, making us a reliable alternative to US Bank and Chase.

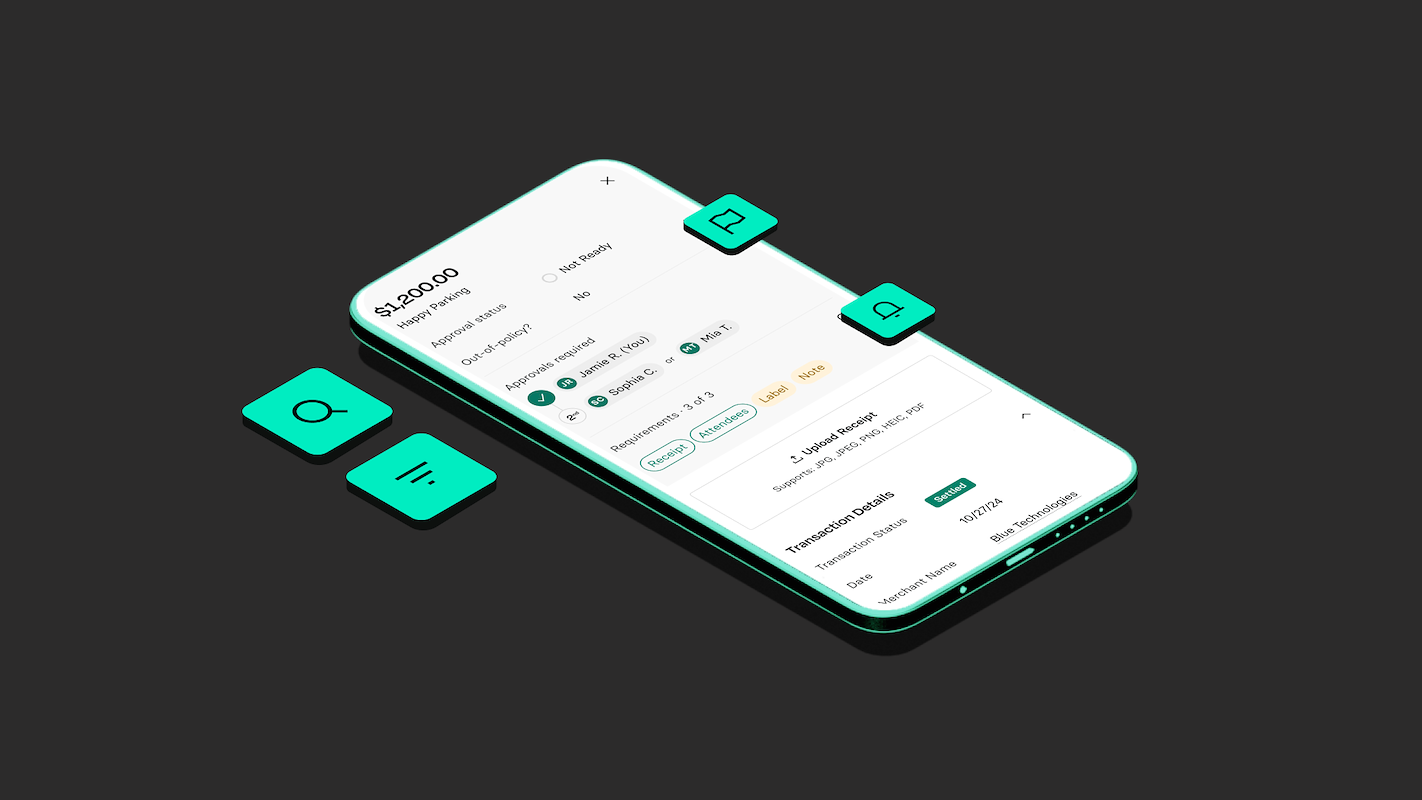

Rho Features

Checking & Savings Accounts: Our accounts come with dedicated support and no ACH fees, addressing the high fees and limited support often experienced with traditional banks.

Corporate Credit Cards: We offer real-time spend monitoring and custom controls, providing greater transparency and control compared to traditional corporate card programs.

Rho Platinum: Enjoy up to 2% cashback1 on banking and card usage, offering more attractive incentives than many traditional banks.

Expense Management: Our tools eliminate the need for manual expense reports, significantly reducing administrative burdens and streamlining financial operations.

AP Automation: Pay hundreds of vendors in minutes with zero platform fees, unlike traditional banks that may charge for such services.

Rho Treasury: Safeguard idle cash and earn higher interest rates, providing better financial growth opportunities than many traditional banks.

Rho Integrations: Seamlessly connect with accounting, HR, and T&E software, reducing the need for manual data entry and improving workflow efficiency.

Rho Pricing

We offer a straightforward and transparent pricing structure that sets us apart from traditional banks like US Bank and Chase. Our pricing is simple, with many essential services available at no cost, making it easier for businesses to manage their finances without worrying about hidden fees.

$0 Same-Day ACH fees: No cost for same-day ACH transactions.

$0 Wire fees: No cost for wire transfers, with some exceptions for international wires.

$0 Monthly plans: No monthly subscription fees for accessing our services.

$0 Support fees: Free live support from day one.

$0 Subscription fees: No subscription fees for using our platform.

$0 Checking account minimum fees: No minimum balance fees for checking accounts.

$0 Connected, in-platform capabilities: Free access to AP, Expense, and Accounting Automation features.

$0 Per-user fees: No fees per user for accessing the platform.

1% Foreign currency transfer: A 1% fee on foreign currency transfers.

You can find all the details about our pricing here.

Why Users Love Rho

We're proud of what we do, but we think our customers say it best. Take a look at why they prefer Rho over other options.

"Rho offers our users a one-touch experience for reporting company expenses on a corporate card." - Tyler M. (Chief Financial Officer, Small-Business)

"The company implementation of Rho was easy and took less than 2 hours." - Pete S. (Mid-Market)

"Rho has all the features of a legacy platform but is designed like a fintech product, so it's constantly evolving and growing to meet our needs." - Kevin K. (Director of Marketing and Analytics, Mid-Market)

Want a firsthand look at Rho? You can request a free demo here.

Which Platform Is Right for Your Business?

Each platform has its strengths: US Bank offers a broad range of financial products, while Chase provides robust business solutions. However, this is where Rho comes in. We offer transparent terms, exceptional support, and a seamless digital experience, addressing common pain points like hidden fees and poor customer service.

Our platform includes no ACH fees, real-time spend monitoring, and AP automation, making financial management simpler and more efficient. For businesses seeking a modern, user-friendly solution, Rho stands out.

Make the Smarter Choice with Rho Today

Curious to see what Rho can do for you? Discover how our platform can transform your business. Get started with Rho today.

Rho is a fintech company, not a bank or an FDIC-insured depository institution. Checking account and card services provided by Webster Bank N.A., member FDIC. Savings account services provided by American Deposit Management Co. and its partner banks. International and foreign currency payments services are provided by Wise US Inc. FDIC deposit insurance coverage is available only to protect you against the failure of an FDIC-insured bank that holds your deposits and subject to FDIC limitations and requirements. It does not protect you against the failure of Rho or other third party. Products and services offered through the Rho platform are subject to approval.The Rho Corporate Cards are issued by Webster Bank N.A., member FDIC pursuant to a license from Mastercard, subject to approval.Investment management and advisory services provided by RBB Treasury LLC dba Rho Treasury, an SEC-registered investment adviser and subsidiary of Rho. Rho Treasury investments are not deposits or other obligations of Webster Bank N.A., or American Deposit Management Co.'s partner banks, are not FDIC insured, are not guaranteed and may lose value. Investment products involve risk, including the possible loss of the principal invested, and past performance does not future results. Treasury and custodial services provided through Apex Clearing Corp. and Interactive Brokers LLC, registered broker dealers and members FINRA/SIPC.1 Up to 2% cashback; terms and conditions apply. See eligibility and complete Rho Cashback Rewards Program terms and conditions here.This content is for informational purposes only. It doesn't necessarily reflect the views of Rho and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.