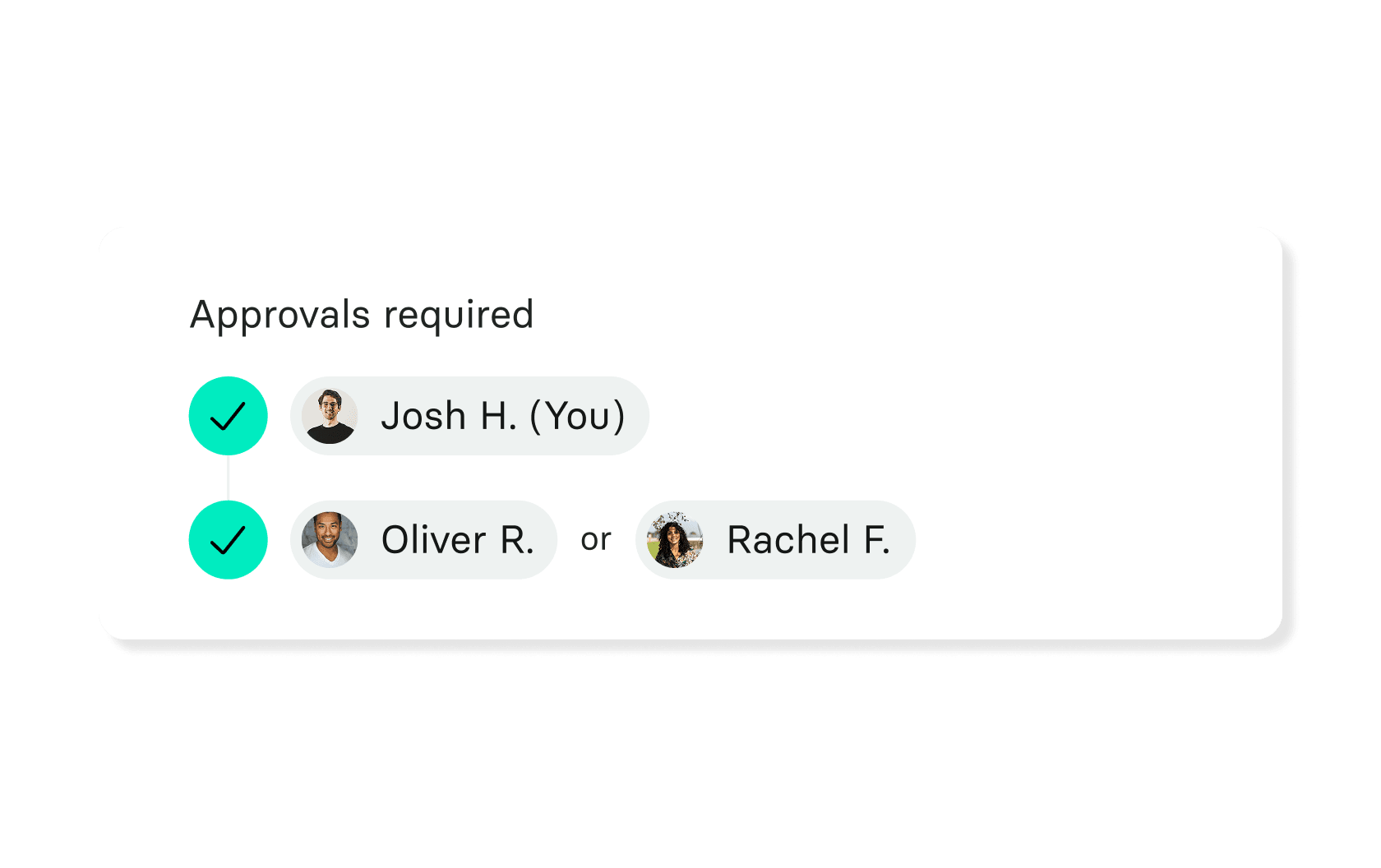

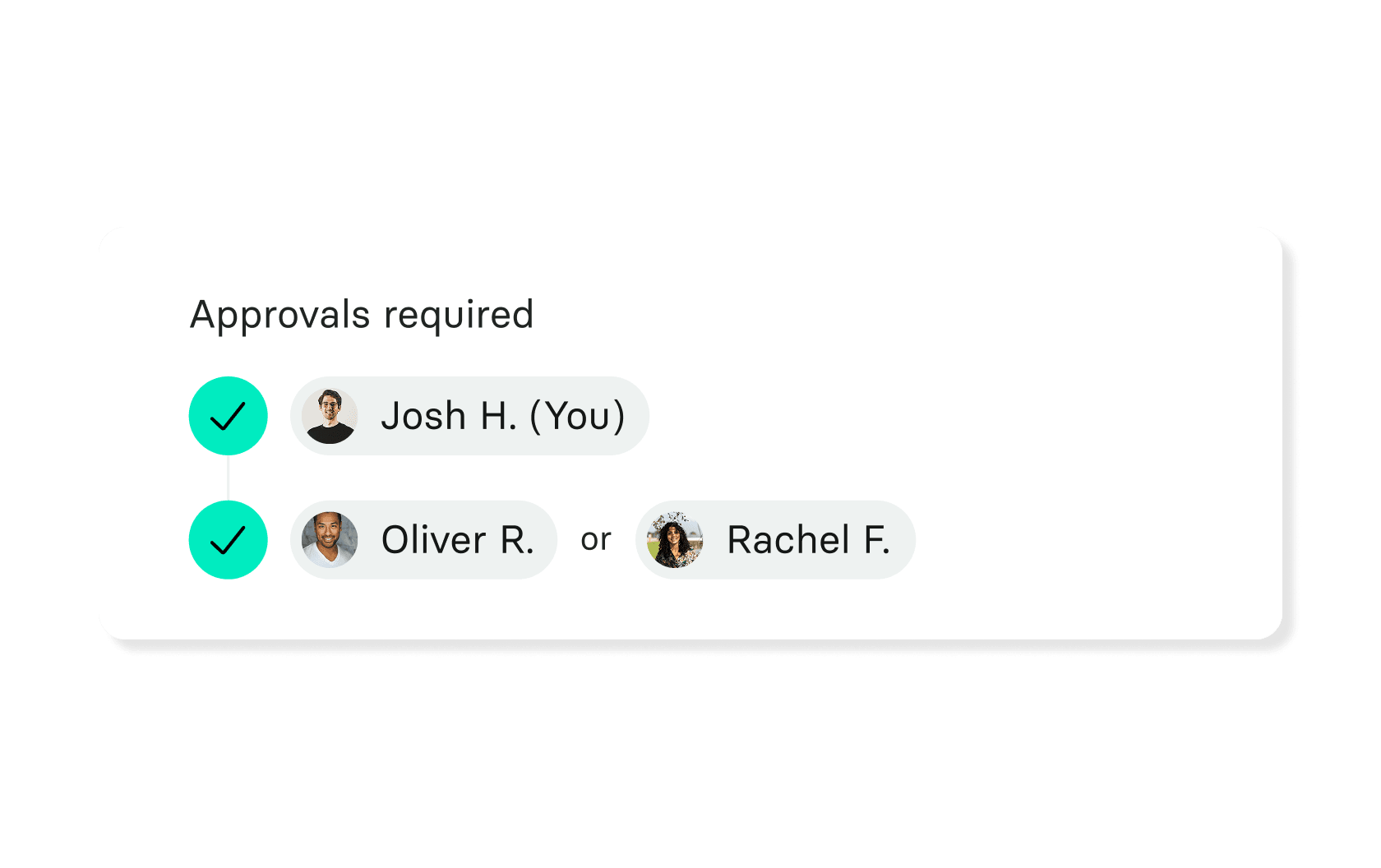

Built-in approval flows

Multi-level approval workflows

Set clear approval paths by team or amount, so spend is reviewed by the right person—without slowing things down.

Rho Expense Management automates policy enforcement with custom spending rules, real-time receipt capture, and automated approvals.

"We have a number of sales folks; working with Rho allows them to quickly submit expenses and focus on delivering better service."

Built to save you time

Set clear approval paths by team or amount, so spend is reviewed by the right person—without slowing things down.

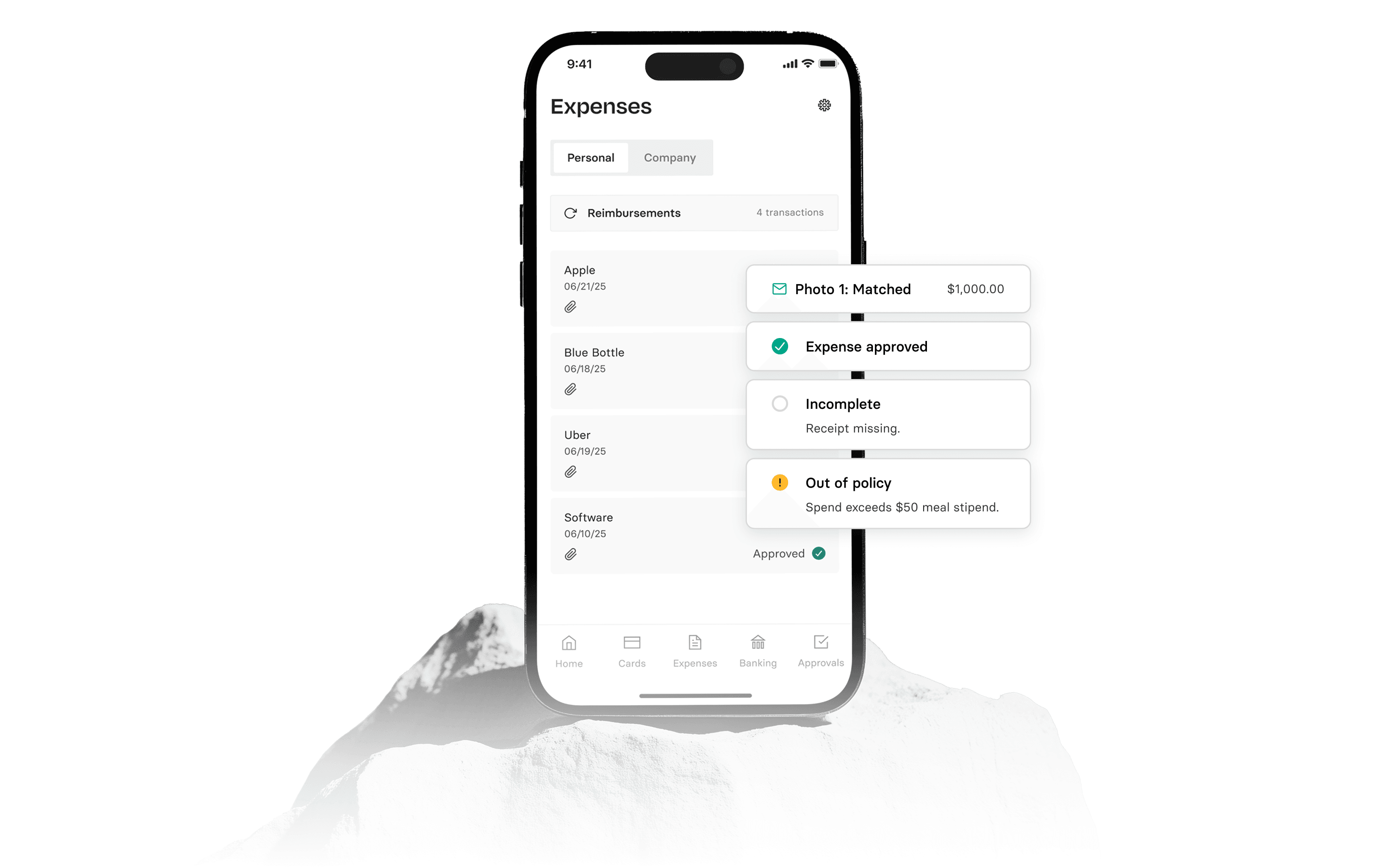

Flag out-of-policy spend instantly. Rho applies your rules in real time—no need to track violations after the fact.

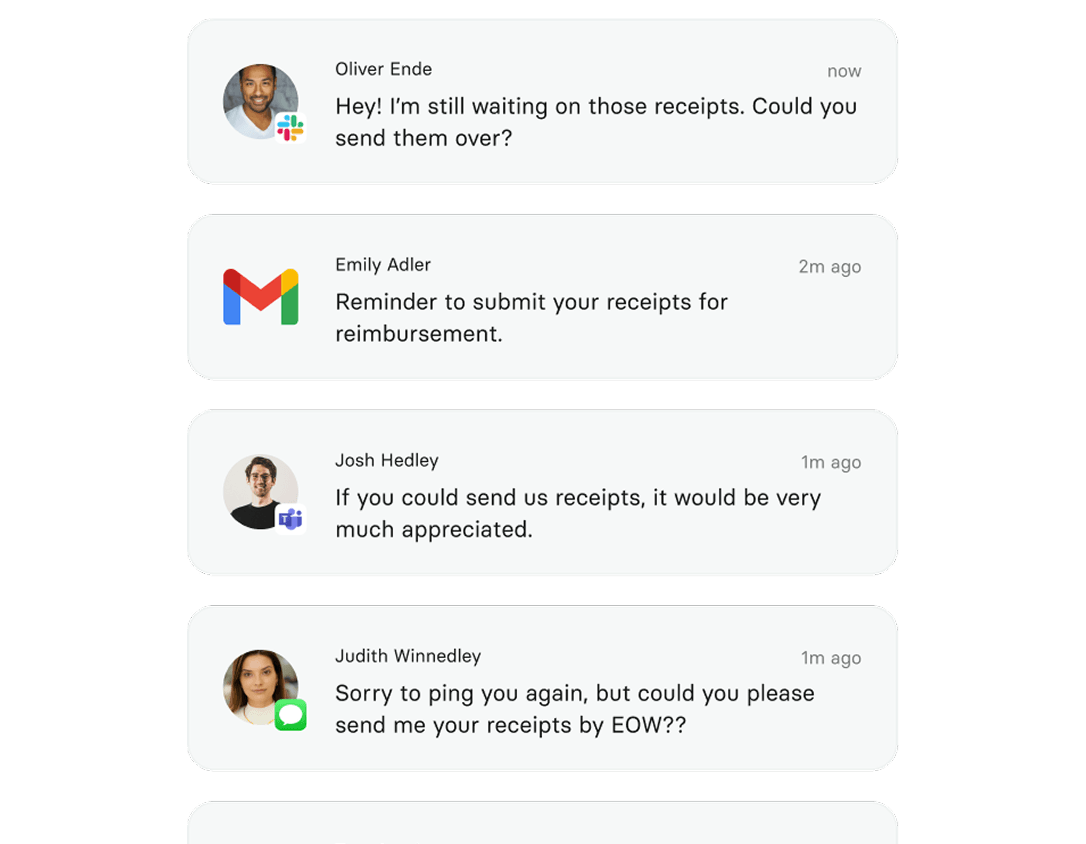

No more chasing. Team members upload receipts and label spend right from the Rho app—before they forget.

Tag every transaction automatically with built-in policy rules

Prompt employees for receipts and memos in real time

Catch out-of-policy spend before it hits your books

Sync transactions to your GL with no manual entry

Give your accountant clean, categorized data from day one

Manage expenses, cards, and approvals in one system

Enhance every finance process, unlocking time and value.

_

Organize your cash with multiple fee-free operating accounts and count on 24/7 customer support.

_

You lack real-time clarity over T&E spending and spend far too many hours

chasing down late receipts and approvals.

Create expense rules by budget, amount, or merchant to keep spend compliant without extra oversight.

Rho prompts employees to upload receipts and fill in details the moment a transaction happens—no chasing needed.

Rho flags out-of-policy transactions automatically, so you skip the approvals you trust and focus only on the edge cases.

Users with admin-level or custom permissions can code expenses with direct accounting attributes. Various Rho attributes can be customized for more controlled employee coding.

Rho's expense management platform is free, with no user or platform usage fees.

For directly integrated businesses, expenses can be automatically coded with attributes pulled directly from the accounting platform. Syncs can be automatically scheduled to eliminate manual bookkeeping in the accounting platform. For those not supported by a direct integration, expenses offers extensive CSV reports & bulk receipt file export to ensure quick reconciliation expenses.

We offer the ability for companies to reimburse their employees for out-of-pocket expenses. In addition to out-of-pocket expenses, employees can submit trip mileage details in the Rho App, which automatically calculates the distance between stops. The reimbursement amount is then calculated based on the current year’s IRS rate or a rate set by the business. Once Reimbursements are approved by direct managers, employees are reimbursed directly from the Rho checking account.

Rho offers the capability to create automated expense rules and approval workflows that can be applied to both Rho Card transactions and reimbursements. You can set up rules by card, user, budget and more to require submissions of receipts, notes, or or Attendees for defined transactions, streamlining your expense management.

Additionally, Rho enables the setup of direct manager approvals, allowing automatic routing of employee expenses up the direct manager approval chain. This can be combined with dollar amount tiers to create multi-level approval flows.

Yes, the Rho app is available on iOS and Android devices for both Rho account admins and employee users.

Employees use the Rho app to manage expenses, upload receipts, request spend limit increases, and access virtual cards for card payments.

Rho admins can do the same plus manage mobile banking needs like depositing checks and checking account balances.