Founder-First Support

Rho includes 24/7 live support with a dedicated account manager, so help is immediate, not ticketed.

See how Rho and Mercury stack up on fees, support, and scale.

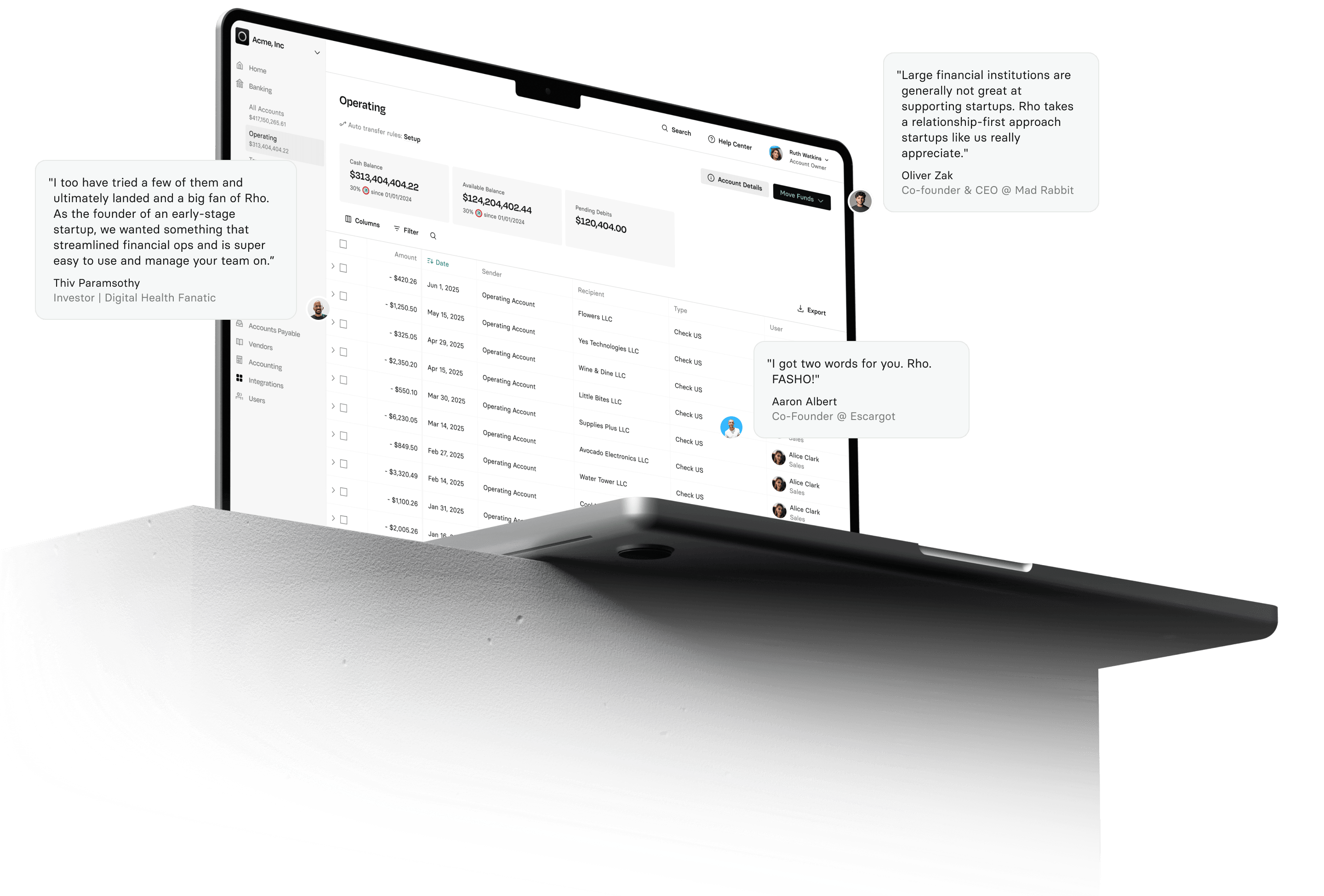

| Rho | Mercury | ||

Cashback | Up to 2% cashback | Up to 1.5% cashback | |

Dedicated Relationship Manager | Every Rho client | Requires Mercury Pro | |

Partner Bank | Webster Bank, N.A. ($70B in assets) | Choice Financial Group, Column N.A., and Evolve Bank & Trust | |

FDIC Coverage | Up to $75M via Rho Savings Account (with yield) | Up to $5M (without yield) | |

Expense Reimbursements | Included for free | $5/month for additional active users after first 20 users |

| Rho | |

Cashback | |

Up to 2% cashback | Up to 1.5% cashback |

Dedicated Relationship Manager | |

Every Rho client | Requires Mercury Pro |

Partner Bank | |

Webster Bank, N.A. ($70B in assets) | Choice Financial Group, Column N.A., and Evolve Bank & Trust |

FDIC Coverage | |

Up to $75M via Rho Savings Account (with yield) | Up to $5M (without yield) |

Expense Reimbursements | |

Included for free | $5/month for additional active users after first 20 users |

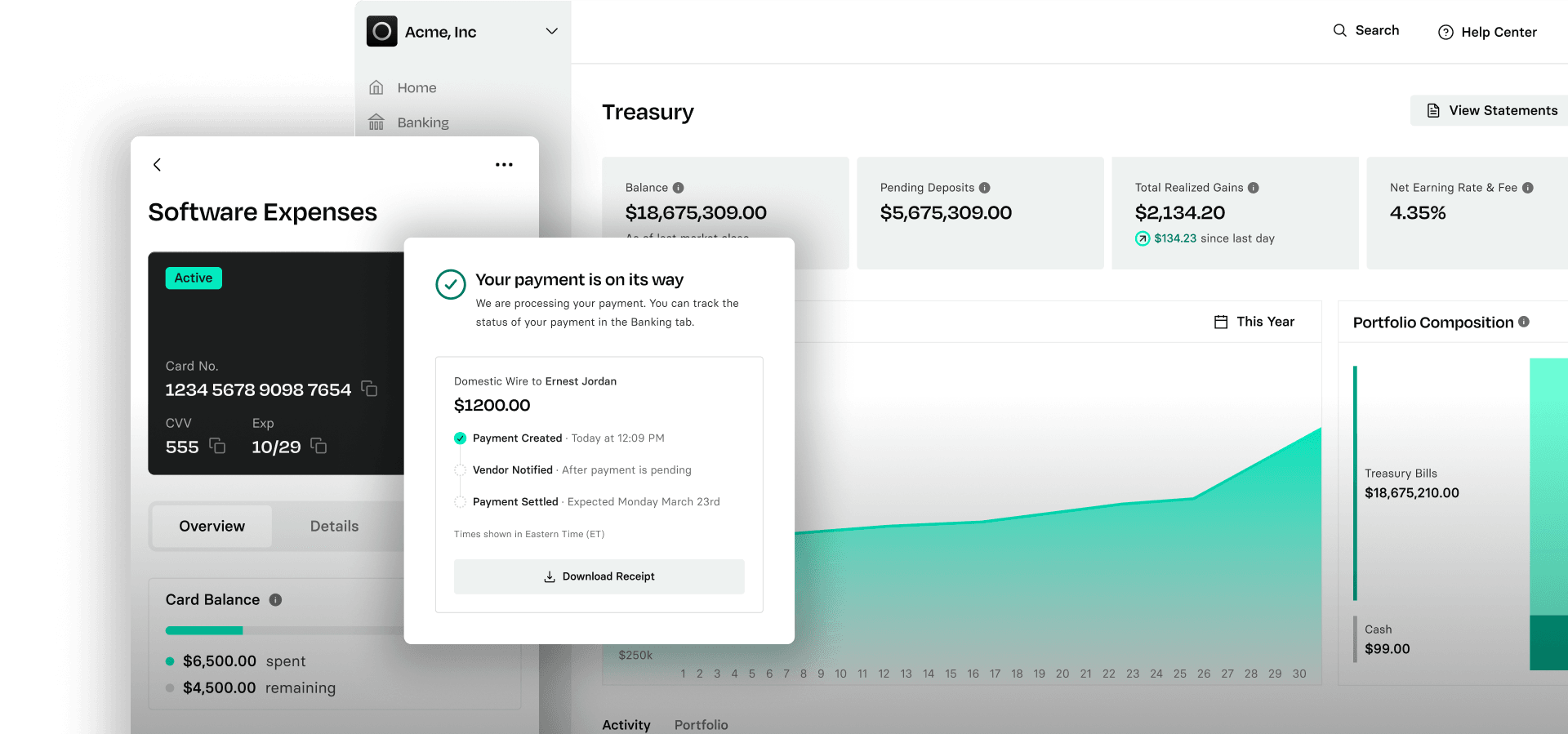

Extend your runway, keep spend controlled, and automate finance busywork so you can focus on building.

Rho includes 24/7 live support with a dedicated account manager, so help is immediate, not ticketed.

Rho is anchored by Webster Bank, N.A., a 100+ year-old institution with $70B+ in assets, which brings stability and trust from day one.

Rho’s core platform is included, banking, cards, bill pay, expenses, and treasury, without monthly plan fees. Mercury now sells Plus and Pro as subscription tiers.

“We’ve been with Rho since we launched Spark. Understanding team spend in real-time has been incredibly important to us.”