15 Best Early Stage Venture Capital Firms

Raising an early-stage round? This guide covers what you need to know, plus 15 venture capital firms that fund startups like yours. Let's get you funded.

Rho Editorial Team

Understanding the venture capital scene is critical when you're raising your first rounds of funding. For founders seeking early-stage venture capital, which includes pre-seed, seed, and Series A rounds, knowing which investors focus on your stage can make all the difference. It helps you target the right people and tailor your pitch effectively.

To help with your fundraise, our team at Rho has put together this overview of top early-stage VC firms. Use this guide to get familiar with the key players relevant to your funding round before you begin outreach.

Rho provides access to business banking, corporate cards, and bill pay — built for startup teams moving fast.

Key Takeaways

- Early-stage venture funding provides startups with capital through pre-seed, seed, and Series A rounds to support initial growth.

- Prominent VCs focusing on early-stage investments include Norwest Venture Partners, General Catalyst, StepStone Group, and Andreessen Horowitz.

- If you’re raising or have just closed a round, Rho’s platform provides FDIC-insured accounts, corporate cards with up to 2% cashback, automated bill pay, spend controls, and real-time accounting integrations.

What is Early Stage Venture Capital?

Early-stage venture capital is the initial funding you receive to build your product and find market fit. Unlike later-stage funding which focuses on scaling, investors at this stage often provide hands-on guidance to help you get started.

Types of Early Stage VC Firms At A Glance

If you're a founder raising an early stage round, it's helpful to know which venture capital firms specialize by geography or sector. Here’s a quick breakdown of those trends across top early stage investors.

Early Stage VC Firms in California

California, particularly the Bay Area, is a major hub for seed and series A venture capital. For example, Andreessen Horowitz and Sequoia Capital are based in Menlo Park, while San Francisco is home to firms like General Catalyst.

East Coast Early Stage VC Firms

On the East Coast, you'll find key hubs for pre-seed venture capital firms and beyond. New York City is home to Insight Partners and General Atlantic, while Wellington Management is a major investor based in Boston.

Early Stage VCs for Financial Services & FinTech

Many firms have a dedicated focus on the financial sector. If you're building a FinTech company, investors like StepStone Group and Plug and Play specialize in financial services and related technologies.

Early Stage VCs for Technology & Software

For founders in deep tech, AI, or SaaS, certain firms have a strong track record. Menlo Ventures has backed AI companies, while Insight Partners is a well-known global software investor.

Of course, many of the most successful early stage VC firms are stage-agnostic and invest across all industries and locations.

To help you identify the right investors, we've gathered information on several top early-stage VC firms. For each one, you'll find details on their locations, industry focus, and what makes them a noteworthy partner for founders.

1. Norwest Venture Partners

Norwest Venture Partners is a venture capital and growth equity firm that invests in businesses from early to late stages. They have a long history of providing capital to support companies throughout their entire growth journey.

The firm has backed several category-defining companies, including LendingClub and the cybersecurity firm FireEye, through to successful IPOs. Their portfolio is diverse, with notable investments in robotics, digital health, and big data analytics.

Founders looking for a long-term partner that can provide funding across multiple stages may find Norwest to be a good fit. Their broad industry focus makes them relevant for startups in many different technology sectors.

- Investment stages: Early-stage venture, late-stage venture, and growth equity.

- Industries of focus: Diversified, with investments in fintech, cybersecurity, digital health, and robotics

- Geographical presence: Palo Alto, California

- Founded: 1961

- Notable portfolio companies: LendingClub, FireEye, 6 River Systems, Omada Health

- Portfolio size: Over 970 investments

You can refer to their website here.

2. General Catalyst

General Catalyst is a venture firm that collaborates with founders from the earliest stages through to growth. They focus on building resilient companies and have a specific interest in applied AI.

The firm is known for backing iconic companies like Airbnb and Stripe, demonstrating their ability to support businesses to a global scale. Their investment thesis spans from seed funding to post-IPO, signaling a commitment to long-term partnerships.

This firm is a strong potential partner if you're building a company in finance or AI and are looking for an investor to stick with you across your entire growth journey. Their broad stage focus means they can provide capital and support from your first check to a public offering.

- Investment stages: Seed, early-stage venture, late-stage venture, and private equity

- Industries of focus: Finance, financial services, and applied AI

- Geographical presence: San Francisco, California

- Founded: 2000

- Notable portfolio companies: Airbnb, Stripe, HubSpot, Kayak, Samsara

- Portfolio size: Over 1,464 investments

You can refer to their website here.

3. StepStone Group

StepStone Group is a global private equity firm that also operates as a venture capital investor. They build custom investment portfolios for their clients, which include direct co-investments into companies.

The firm has a clear focus on financial services, FinTech, and real estate. Their model of integrating primary, secondary, and co-investments gives them flexibility in how they structure deals and support companies.

If you are a founder in the FinTech or financial services space, StepStone could be a valuable partner. Their deep industry specialization and broad network as a major private equity player can provide significant advantages.

- Investment stages: Early Stage Venture

- Industries of focus: Banking, Financial Services, FinTech, Real Estate Investment, Venture Capital

- Geographical presence: New York, New York

- Founded: 2007

- Portfolio size: 101 investments

You can refer to their website here.

4. Andreessen Horowitz

Andreessen Horowitz, also known as a16z, is a venture capital firm that invests across all stages, from seed to late-stage growth. Based in Menlo Park, they manage multiple funds to support companies throughout their entire lifecycle.

The firm has a track record of backing category-defining companies, with a portfolio that includes Airbnb, Stripe, and Coinbase. Their investment in GitHub, which was later acquired by Microsoft for $7.5 billion, highlights their focus on businesses with massive potential.

Founders with ambitious, high-growth technology companies may find a16z to be a good fit. If you are looking for a long-term partner that can provide capital across multiple funding rounds, their stage-agnostic approach is a key advantage.

- Investment stages: Seed, early-stage venture, late-stage venture

- Industries of focus: Finance, financial services, and technology

- Geographical presence: Menlo Park, California

- Founded: 2009

- Notable portfolio companies: GitHub, Coinbase, Airbnb, Stripe, Oculus VR

- Portfolio size: Over 1,690 investments

You can refer to their website here.

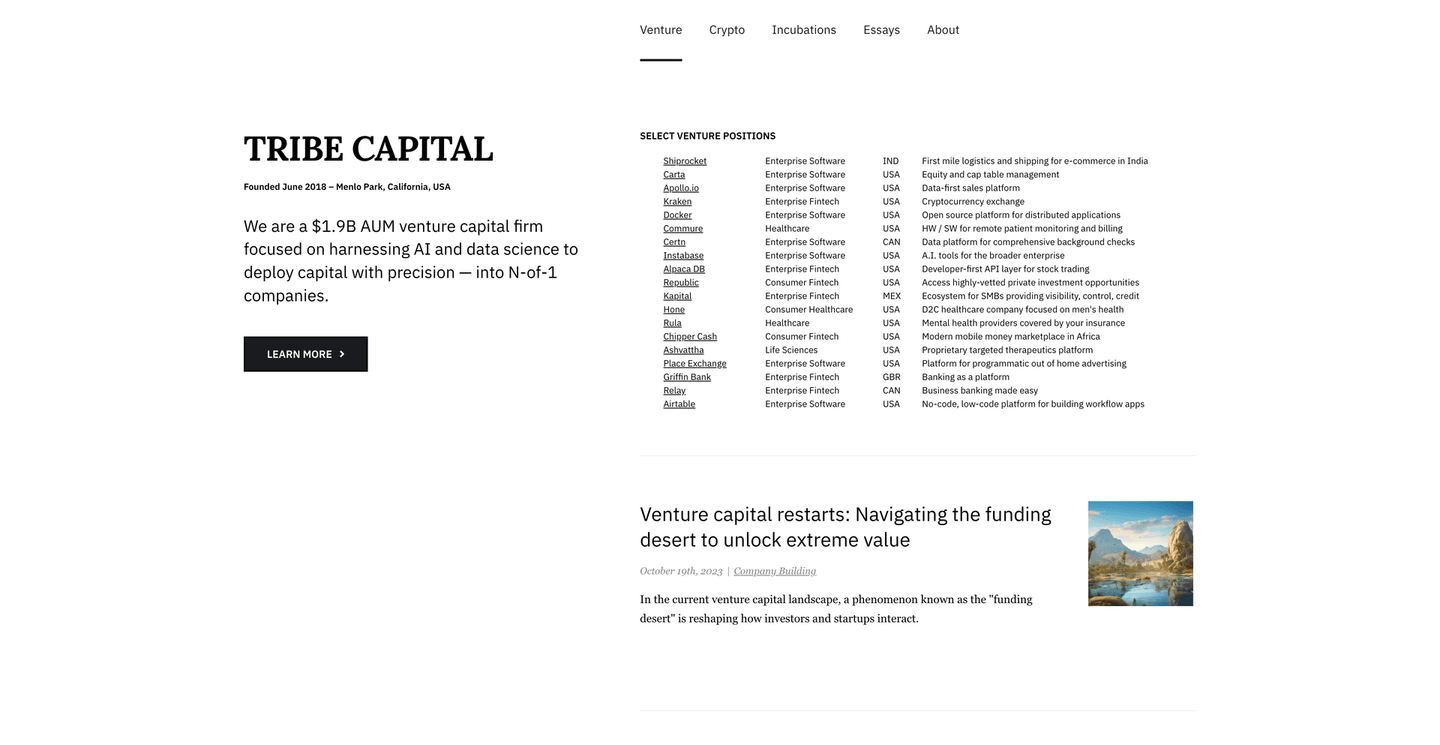

5. Tribe Capital

Tribe Capital is a venture firm that uses data science to inform its investments in both venture and crypto markets. Their approach is built on identifying companies with a durable competitive advantage.

The firm uses its data science focus to back companies showing early signs of product-market fit. Their portfolio includes the crypto exchange Kraken, one of the earliest crypto unicorns, and sales platform Apollo.io, which raised a $100 million Series D in 2023.

If you are building a data-intensive business, particularly in FinTech or SaaS, Tribe Capital could be a good match. Founders who appreciate a quantitative, product-focused investment thesis may find their approach valuable.

- Investment stages: Seed, early-stage, and late-stage venture

- Industries of focus: Finance, Financial Services, Venture Capital

- Geographical presence: San Francisco, California

- Founded: 2018

- Notable portfolio companies: Kraken, Carta, Airtable, Shiprocket, Apollo.io

- Portfolio size: 240 investments

You can refer to their website here.

6. Menlo Ventures

Menlo Ventures is a venture capital firm that provides capital for companies from seed to growth stages. They have a long history of investing in AI, consumer, and life science technologies.

The firm has a track record of backing transformative companies, including an early investment in Siri before its acquisition by Apple, as well as Uber and Roku. Their support for AI company Anthropic and direct-to-consumer brand Warby Parker shows their continued focus on category-defining businesses.

If you are a founder in the AI, consumer, or life sciences sectors, Menlo Ventures could be a strong partner. Their ability to invest from seed to growth makes them a good fit for teams seeking a long-term investor.

- Investment stages: Seed to growth stages

- Industries of focus: AI, consumer, and life science technologies

- Geographical presence: San Francisco, California

- Founded: 1976

- Notable portfolio companies: Uber, Roku, Siri, Anthropic, Warby Parker

- Portfolio size: Over 829 investments

You can refer to their website here.

7. General Atlantic

General Atlantic is a global growth equity firm that provides capital and strategic support to companies at an inflection point. They operate as a long-term partner, helping businesses scale their operations and expand into new markets.

The firm invests across consumer, financial services, and technology, backing established leaders like the activewear brand Vuori and SaaS platform Kyriba. Their portfolio also includes innovative companies like the generative AI research company Runway, showing a focus on high-growth, category-defining businesses.

This firm is a good fit if you lead a growth-stage company with proven traction and are looking for a partner to help with global expansion. Their model is built to support businesses as they scale, rather than focusing on the earliest seed stages.

- Investment stages: Early-stage venture, late-stage venture, and private equity

- Industries of focus: Consumer, financial services, and technology

- Geographical presence: New York, New York

- Founded: 1980

- Notable portfolio companies: Runway, Vuori, Adevinta, Kyriba, Athletic Brewing Company

- Portfolio size: 481 investments

You can refer to their website here.

8. Accel

Accel is a venture capital firm that invests from seed to growth stages, supporting a global community of entrepreneurs. They partner with founders to build enduring, category-defining companies.

The firm is known for making one of the highest-return VC investments ever with its early check into Facebook. Other landmark exits include Flipkart's acquisition by Walmart, Slack's sale to Salesforce, and Dropbox's IPO, showing a pattern of backing globally significant businesses.

Accel is an excellent match if you're a founder with a high-growth consumer or SaaS company aiming for massive scale. Their history suggests a preference for businesses with the potential to become household names.

- Investment stages: Seed, early-stage venture, late-stage venture, private equity, convertible note

- Industries of focus: Finance, financial services, and venture capital

- Geographical presence: Palo Alto, California

- Founded: 1983

- Notable portfolio companies: Facebook, Flipkart, Dropbox, Slack, Bumble

- Portfolio size: Over 2,195 investments

You can refer to their website here.

9. Plug and Play

Plug and Play operates as a global innovation platform, connecting startups with corporations and investors. Their model combines venture capital with an accelerator program and co-working spaces.

The firm is known for its industry-specific accelerator programs that facilitate direct collaboration between startups and large corporations. Their portfolio includes foundational tech companies like PayPal and Dropbox, as well as Honey, which was acquired by PayPal for $4 billion.

This firm is a great fit if you're an early-stage founder in FinTech or smart city technology who wants direct access to corporate partners. Their ecosystem is designed to provide more than just capital, offering mentorship and business development opportunities.

- Investment stages: Seed, early-stage venture, non-equity assistance, and private equity

- Industries of focus: Financial Services, FinTech, Smart Cities

- Geographical presence: Sunnyvale, California

- Founded: 2006

- Notable portfolio companies: PayPal, Dropbox, Honey

- Portfolio size: Over 2,180 investments

You can refer to their website here.

10. Pear VC

Pear VC is a venture capital firm that partners with companies at the pre-seed and seed stages. They focus on helping founders build their businesses from the ground up.

The firm is known for getting in on the ground floor of future market leaders, including an early investment in DoorDash. Their portfolio also includes the precision-oncology company Guardant Health and the lending marketplace Credible Labs, showing a pattern of backing companies that achieve major exits.

Pear VC is a strong choice if you are a founder at the earliest stages of building a technology company. Their track record suggests they are skilled at identifying and supporting businesses with the potential for massive scale.

- Investment stages: Pre-seed, seed, and early-stage venture

- Industries of focus: Angel Investment, Education, Financial Services, Venture Capital

- Geographical presence: Menlo Park, California

- Founded: 2013

- Notable portfolio companies: DoorDash, Guardant Health, Credible Labs

- Portfolio size: 402 investments

You can refer to their website here.

11. Wellington Management

Wellington Management is a private investment firm that provides capital across various stages, from early venture to private equity. They serve institutional clients by managing investments across public and private markets.

The firm has a history of backing high-profile technology companies through to their public listings, including Airbnb, Affirm, and Coinbase. Their broad investment mandate covers everything from early-stage venture to debt and private equity.

Wellington may be a good partner if you lead a company with proven market fit and are preparing for significant scaling or a public offering. Their experience with late-stage growth and IPOs is a key asset for founders with ambitious long-term goals.

- Investment stages: Debt, early-stage venture, late-stage venture, and private equity

- Industries of focus: Asset management, finance, financial services, and insurance

- Geographical presence: Boston, Massachusetts

- Founded: 1933

- Notable portfolio companies: Airbnb, Affirm, Coinbase, Coupang, ACV Auctions

- Portfolio size: 290 investments

You can refer to their website here.

12. Madrona

Madrona is a venture firm that primarily invests in companies based in the Pacific Northwest, supporting them from early stages through to growth. They have a long-standing presence in the Seattle tech scene, backing founders from day one.

The firm has a strong record with enterprise software and cloud companies, including Apptio, which was acquired by IBM for $4.6 billion, and the work-management platform Smartsheet, which had a successful IPO in 2018.

Madrona is a great potential partner if you're a founder in the Pacific Northwest, particularly in the enterprise SaaS or cloud sectors. Their regional focus and history of guiding companies to major exits make them a key player in the Seattle ecosystem.

- Investment stages: Seed, early-stage, and late-stage venture

- Industries of focus: Cloud data services, finance, and service industries

- Geographical presence: Seattle, Washington

- Founded: 1995

- Notable portfolio companies: Apptio, Smartsheet, Redfin, Rover.com, Impinj

- Portfolio size: Over 536 investments

You can refer to their website here.

13. Insight Partners

Insight Partners is a global software investor that partners with high-growth technology and internet companies. They provide capital and support to help businesses scale from their early stages through to maturity.

The firm is known for backing major software companies to significant outcomes, including Shopify’s IPO and DocuSign’s growth into an industry standard. Their focus is clearly on software businesses with the potential for massive scale.

If you are a founder of a high-growth software company, Insight Partners could be a strong fit. Their ability to invest across multiple stages makes them a valuable long-term partner for scaling your business.

- Investment stages: Seed, early-stage venture, late-stage venture, private equity, convertible note, and debt

- Industries of focus: Software, internet, finance, and financial services

- Geographical presence: New York, New York

- Founded: 1995

- Notable portfolio companies: Shopify, DocuSign, Qualtrics, SentinelOne, Twitter

- Portfolio size: Over 1,149 investments

You can refer to their website here.

14. International Finance Corporation

The International Finance Corporation (IFC) is the private sector investment arm of the World Bank Group, focused on providing venture capital and private equity in developing countries. Their core mission is to advance economic development by investing in private enterprises across emerging markets.

The IFC backs companies with significant global reach and impact, including the online learning platform Coursera and the Nigerian fintech unicorn Interswitch. Their ability to offer debt alongside equity from seed to late stages gives them flexibility in how they support companies.

This firm is an ideal partner if your company operates in or serves a developing country, particularly in the financial services or technology sectors. Founders seeking an investor with deep institutional backing and a focus on impact will find the IFC to be a strong match.

- Investment stages: Seed, early-stage venture, late-stage venture, private equity, and debt

- Industries of focus: Finance, financial services, and funding platforms

- Geographical presence: Washington, D.C.

- Founded: 1956

- Notable portfolio companies: Coursera, Interswitch, Remitly, Planet Labs, BigBasket

- Portfolio size: Over 603 investments

You can refer to their website here.

15. Sequoia Capital

Sequoia Capital is a venture capital firm that partners with founders across a wide range of stages, from seed to post-IPO. They invest in multiple sectors, including technology, healthcare, and finance.

The firm is distinguished by its history of backing legendary companies like Apple, Google, and Nvidia from their early days. This track record shows a focus on businesses that can define or create massive new markets.

Sequoia is a good match for founders with ambitious, long-term visions to build enduring companies. If you are creating a business with the potential for global scale, their experience and network could be invaluable.

- Investment stages: Seed, early-stage venture, late-stage venture, post-IPO

- Industries of focus: Energy, financial, enterprise, healthcare, internet, and mobile

- Geographical presence: Menlo Park, California

- Founded: 1972

- Notable portfolio companies: Apple, Google, Nvidia, YouTube, Zoom

- Portfolio size: Over 2,138 investments

You can refer to their website here.

What Startup Founders Should Look for in a Early Stage VC Firm

Choosing the right early-stage venture capital firm is about finding a true partner. Beyond the capital, focus on alignment. As the firms above illustrate, many investors specialize by industry, such as B2B software, or by geography, with strong hubs in traditional centers and growing cities like Austin.

When evaluating potential partners for your pre-seed or seed venture capital round, consider these points:

- Portfolio Fit: Does your company align with their existing investments and expertise?

- Stage Focus: Do they actively invest at your current stage (pre-seed, seed, Series A)?

- Value-Add: What operational support, network access, or mentorship do they offer?

This research will help you build a targeted list of investors who can provide not just seed funding, but also the strategic guidance needed to grow your business.

Raise Confidently with Rho

Building a focused list of relevant investors is one of the most effective ways to manage your fundraise. It allows you to direct your limited time and energy toward the conversations that are most likely to succeed.

If you’ve just raised or are planning to, Rho can help you set up your financial stack in minutes. This ensures your capital is ready to be deployed as soon as it hits your account.

Our platform assists in managing your new capital with business banking, corporate cards, and automated bill pay. These tools are designed to help you put your funding to work efficiently from day one.

FAQs about Early Stage Venture Capital

What is the difference between seed capital vs venture capital?

Seed capital is the initial funding used to validate your business idea, often from pre-seed venture capital firms. Venture capital is a broader term for financing at various stages, including seed and Series A, to fuel growth and scaling.

What do pre-seed VC firms look for in a startup?

Pre-seed VC firms prioritize the founding team's expertise and vision. They also assess the market size and the problem you're solving. Traction is less critical than a compelling idea, whether you're in Chicago or Silicon Valley.

How do venture capital returns by stage typically vary?

Venture capital returns by stage reflect risk. Early-stage venture capital funds expect higher returns to compensate for greater risk. Later stages offer more moderate returns as companies are more established and the investment is considered safer.

Are there early stage VCs for specific industries like biotech?

Yes, many of the most successful early stage VC firms specialize. You can find investors focused on areas like early stage life science venture capital, FinTech, or sustainability, providing deep industry expertise.

What is a typical seed funding venture capital round size?

A venture capital seed funding round typically ranges from $1 million to $3 million. The exact amount depends on your industry, location, and the capital needed to reach key milestones before raising a Series A venture capital round.

How can I manage my finances after raising a seed round?

Once you receive venture capital seed money, efficient financial management is key. Our platform helps you manage your new capital with integrated banking, corporate cards, and spend controls. Get started with Rho to deploy your funds wisely.