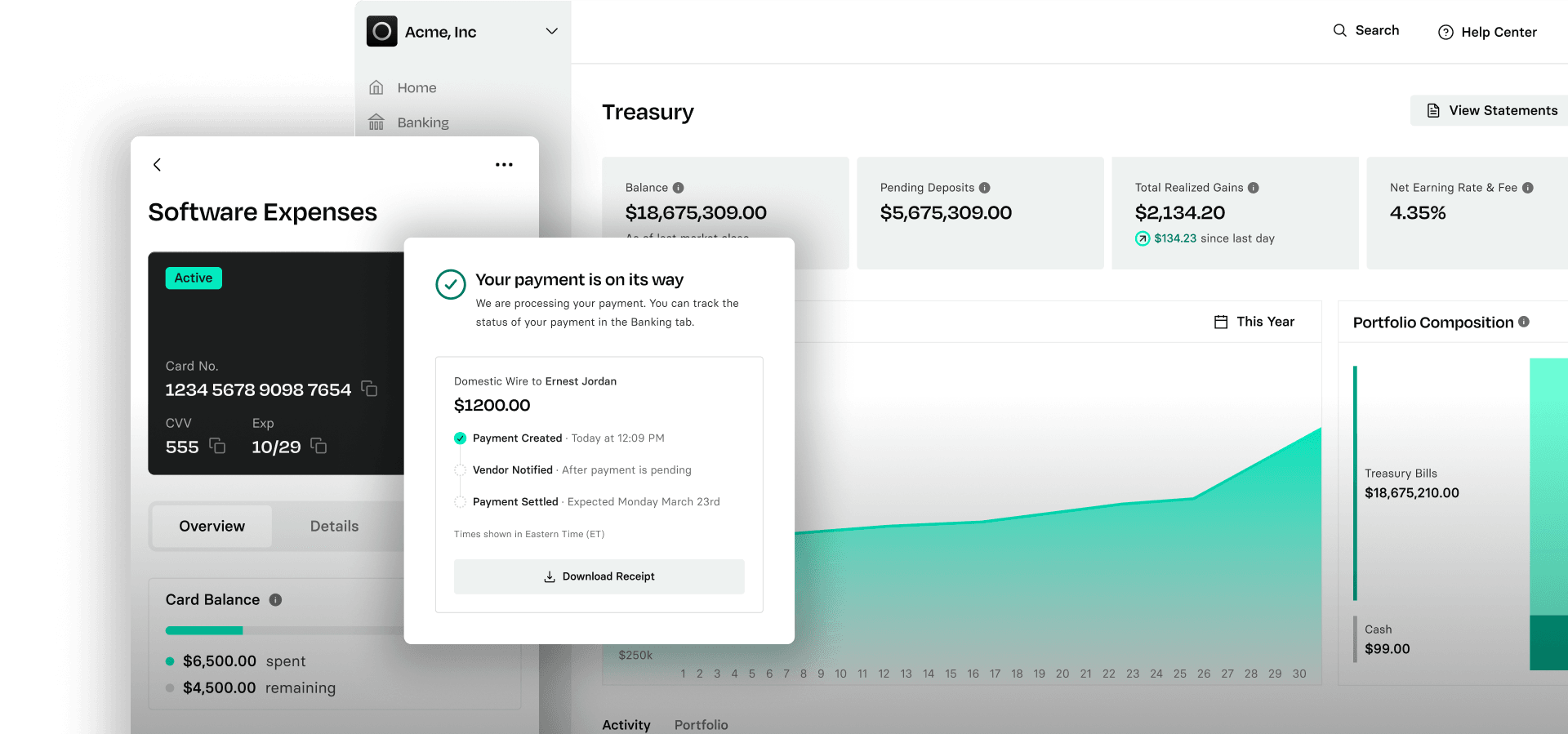

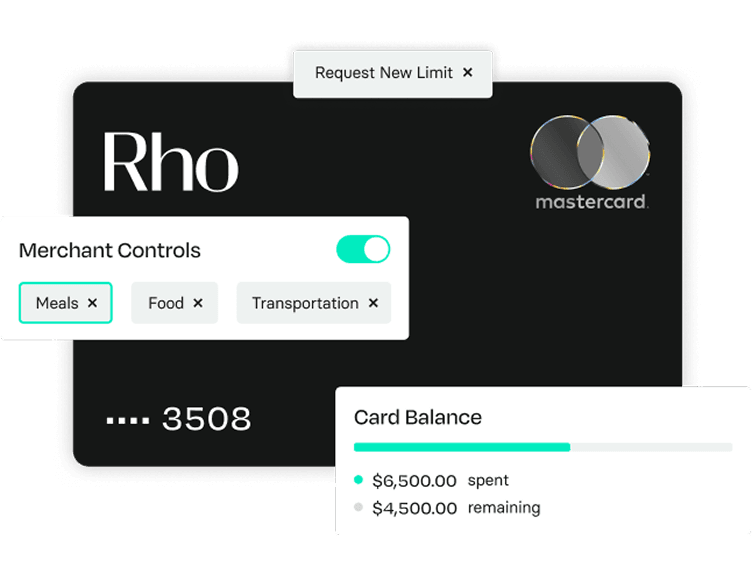

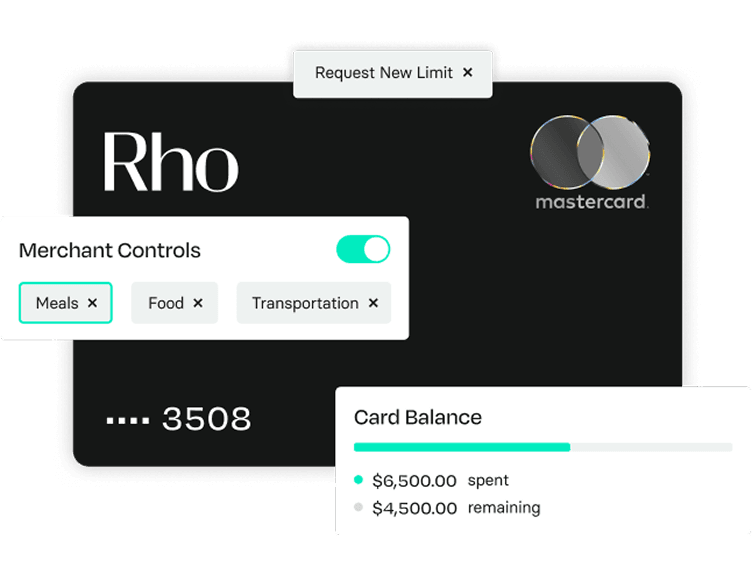

CONTROL COMPANY SPEND

Rho Corporate Cards

Track and control team spend in real time—with 2% cashback and built-in compliance.

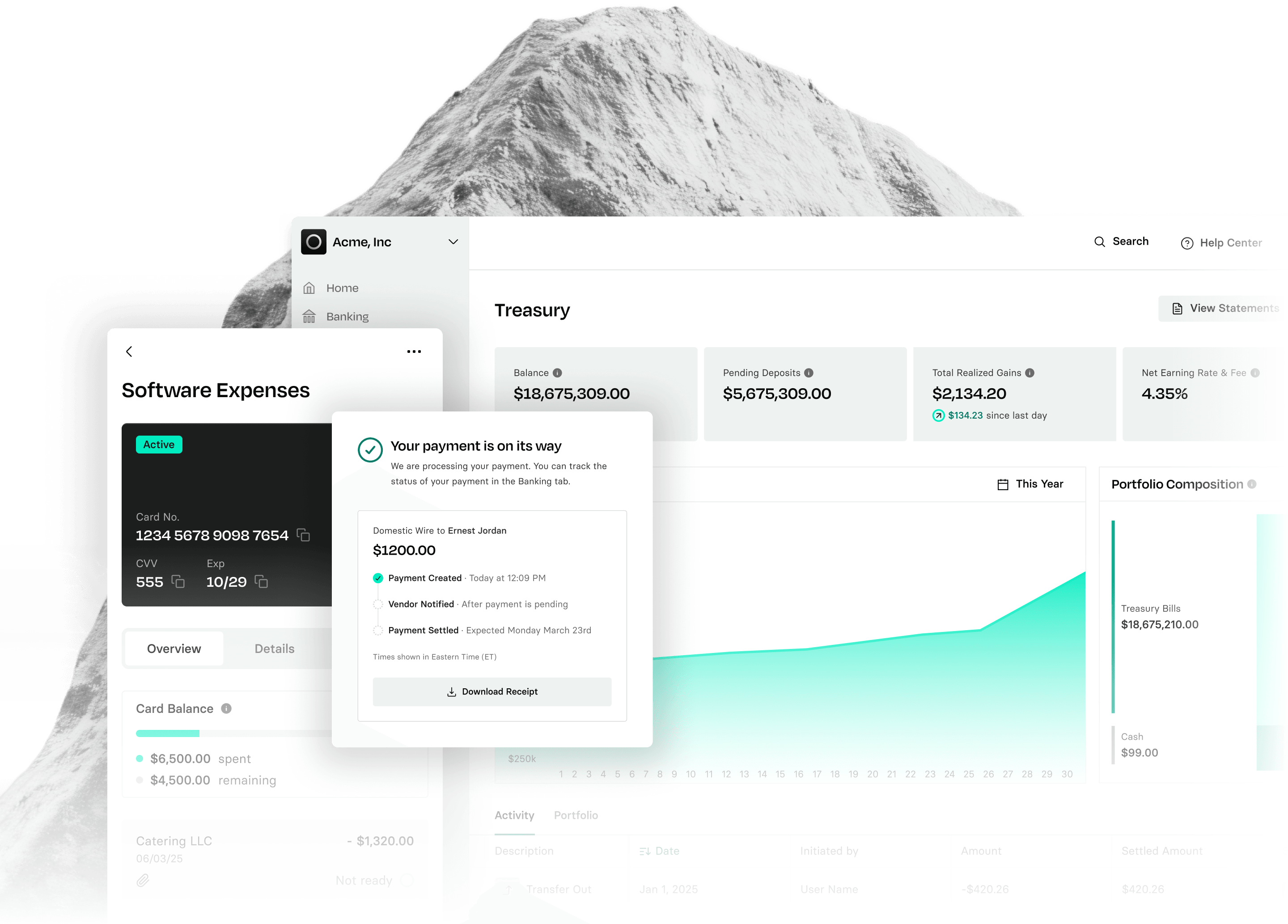

Simplify how you manage cash, pay vendors, and track expenses—so you can stay focused on running the business.

“We’re growing fast. Rho has cut our workloads in half and allows us to minimize the time and resources we spend managing our finances.”

Rho helps you manage spend, cash, and payables in one place—without juggling tools or paying platform fees.

Track and control team spend in real time—with 2% cashback and built-in compliance.

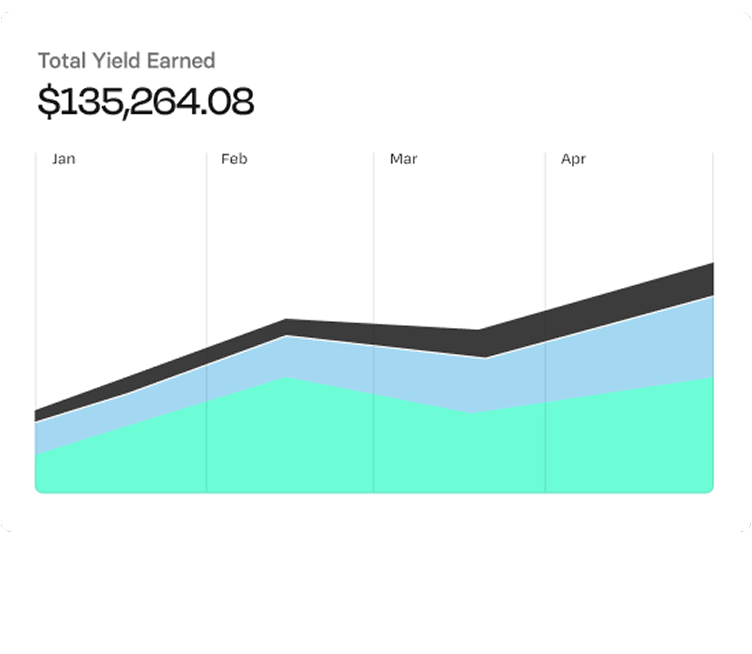

Earn competitive yield on idle cash, with next-day liquidity and no lockups.

No ACH fees, 24/7 support, and one login to manage your core operating cash.

Make it easy for employees to spend—and for your team to stay compliant without chasing receipts.

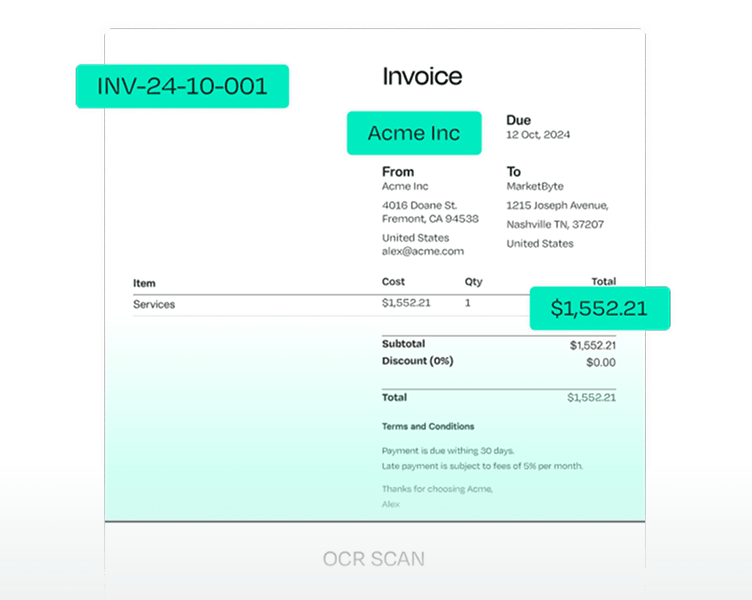

Upload, approve, and pay invoices in minutes. No platform fees, no duplicate entry.

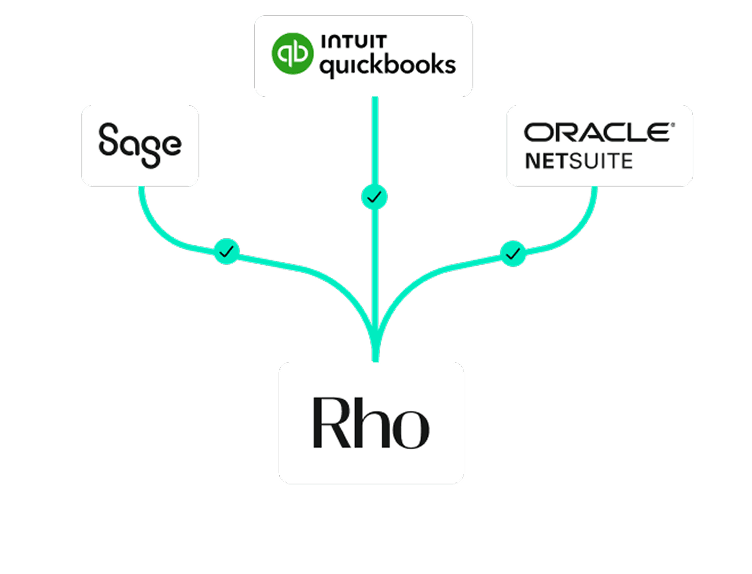

Connect Rho to your accounting software and skip the spreadsheet reconciliation.

Rho gives business owners a simpler way to control spending, manage cash, and eliminate unnecessary fees—all in one platform.

One platform to manage banking, cards, bill pay, and accounting

Real, responsive support when you need it

No ACH, overdraft, or platform fees—ever

Built to scale as your business grows

Expense, AP, and accounting automation included at no extra cost

Backed by an institutional partner bank (Webster Bank, N.A., Member FDIC)

Choose from U.S. Treasury Bills or the Morgan Stanley MULSX Mutual Fund to put your idle cash to work

Let Rho automate finance busywork so you can stay focused on serving your customers.