Earn without lockups

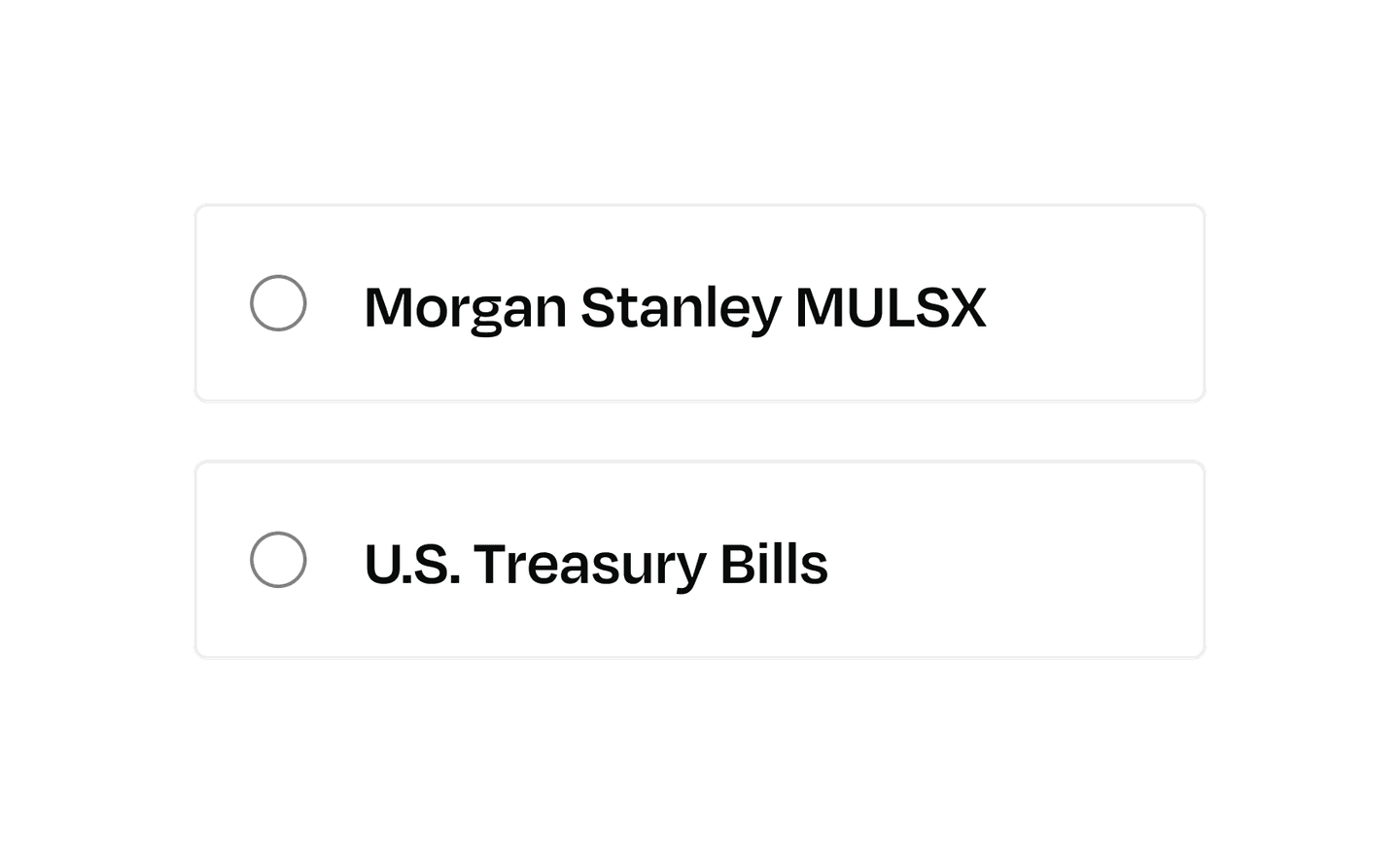

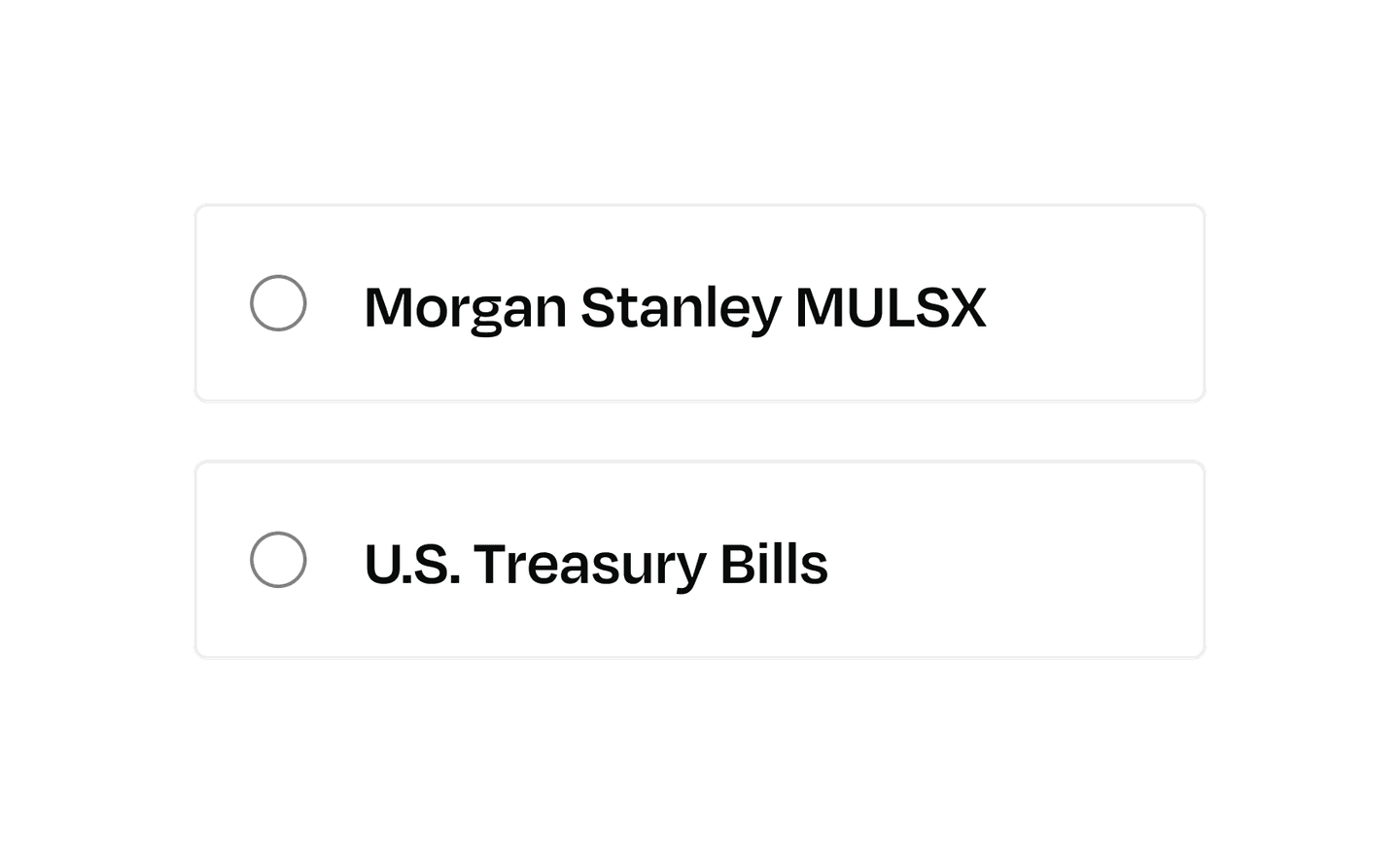

Pick your investments

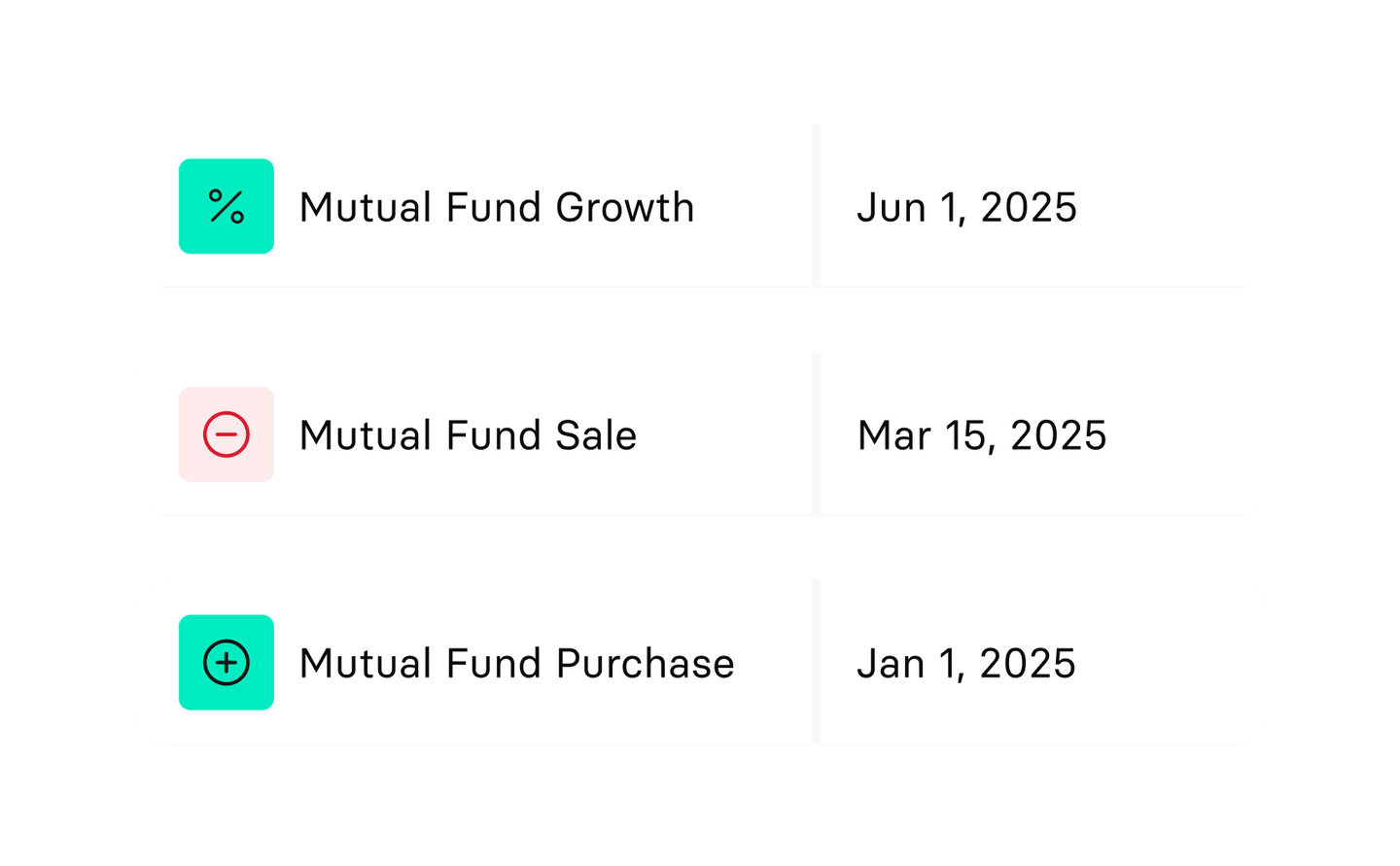

Select U.S. Treasury Bills or the Morgan Stanley MULSX Mutual Fund to start earning on idle cash—no lockups, no extra tools.

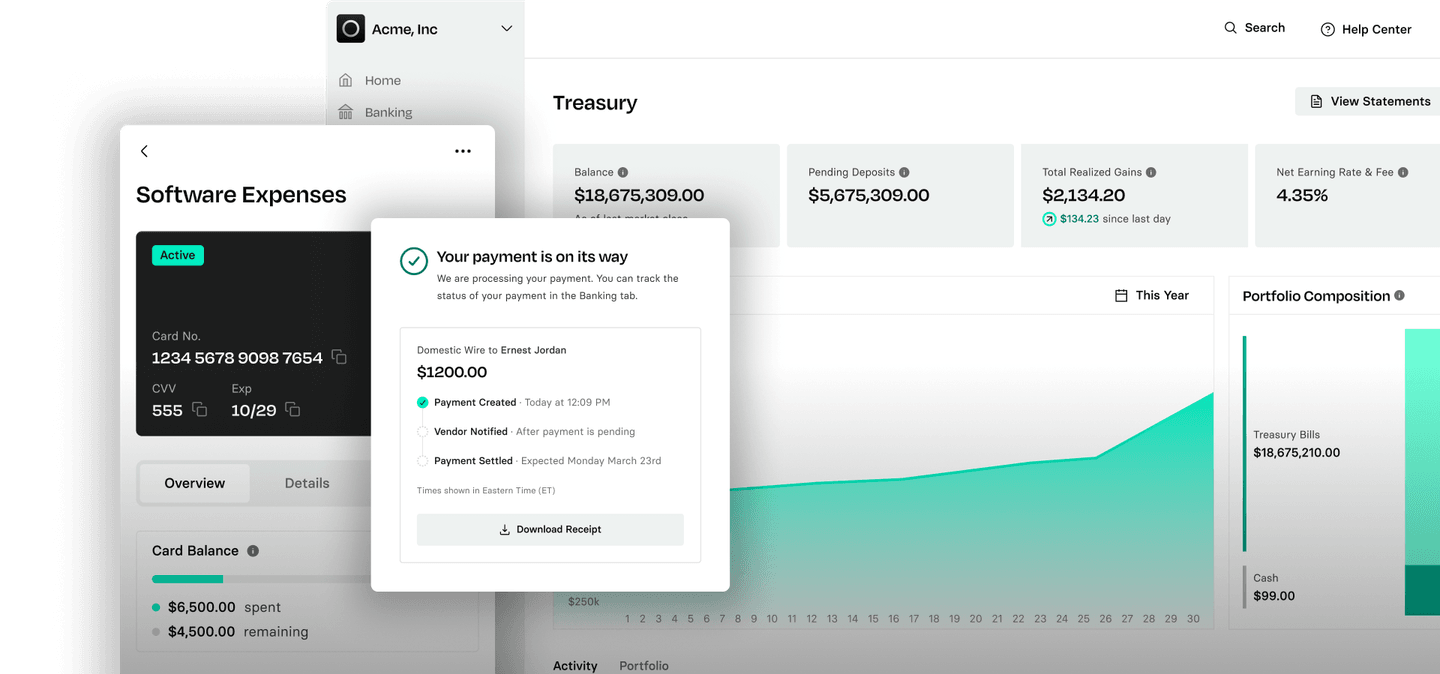

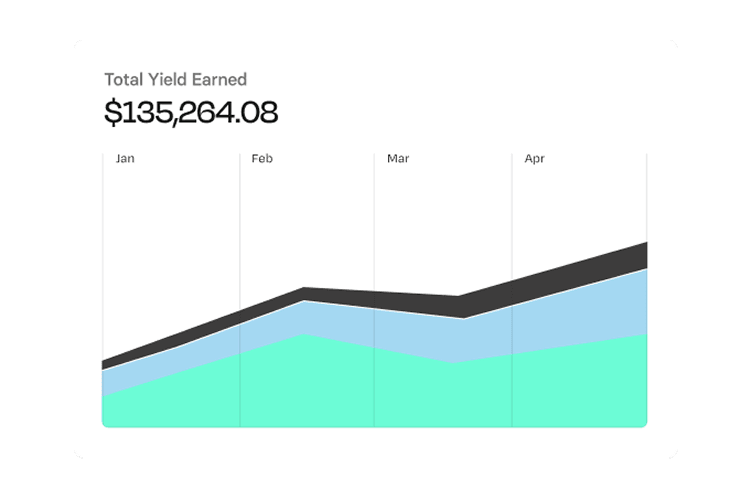

Automate your treasury strategy and start putting your cash to work with Rho Treasury.

Put your idle cash to work

Select U.S. Treasury Bills or the Morgan Stanley MULSX Mutual Fund to start earning on idle cash—no lockups, no extra tools.

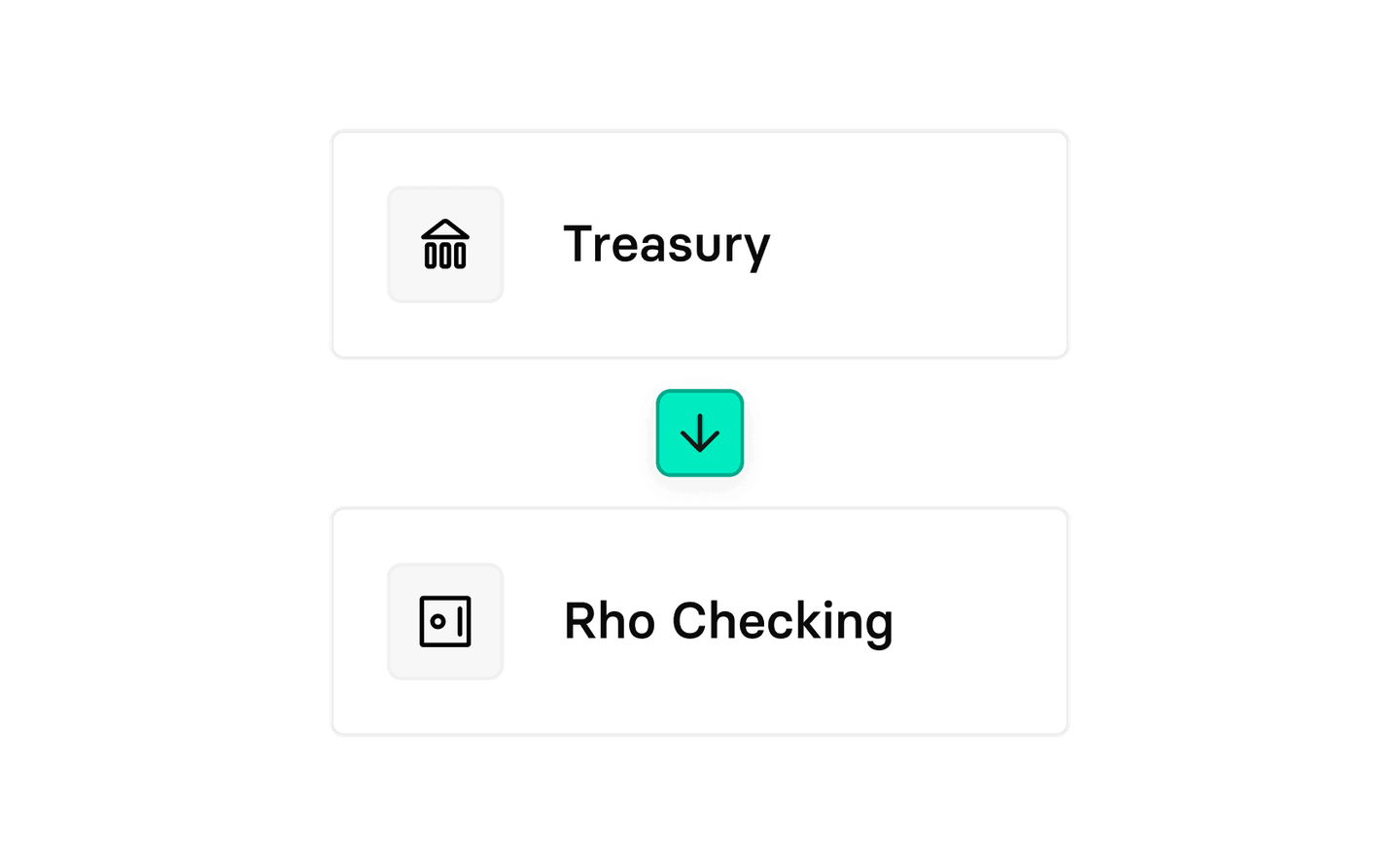

Set rules once and let Rho handle the rest. Funds move automatically between Treasury and Checking as cash needs change.

Treasury activity flows directly into your books for smoother reconciliation and a faster month-end close.

Liquidity, control, and yield - with zero busywork

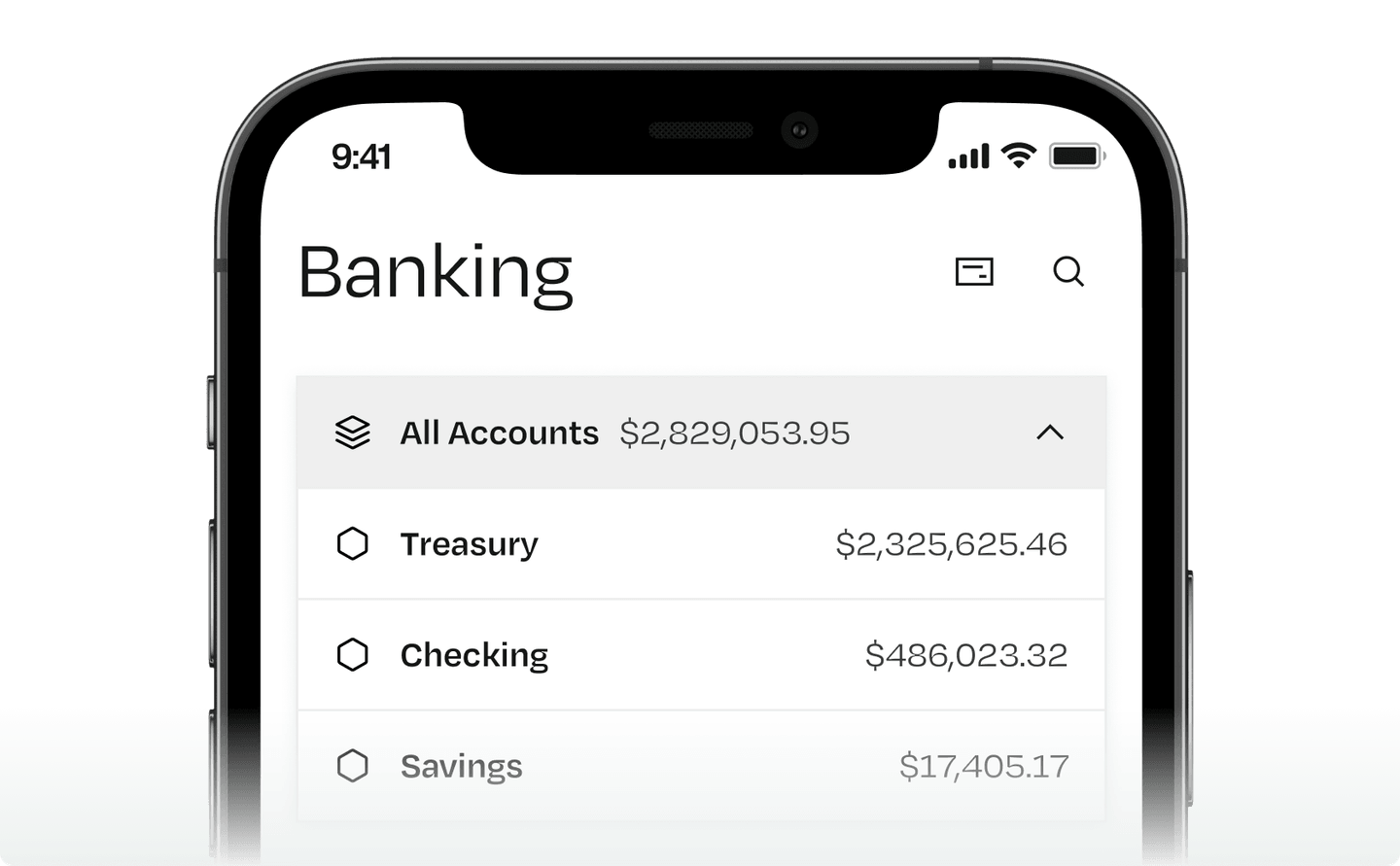

Manage cash, cards, and payables from one platform—no tabs to juggle or exports to chase down.

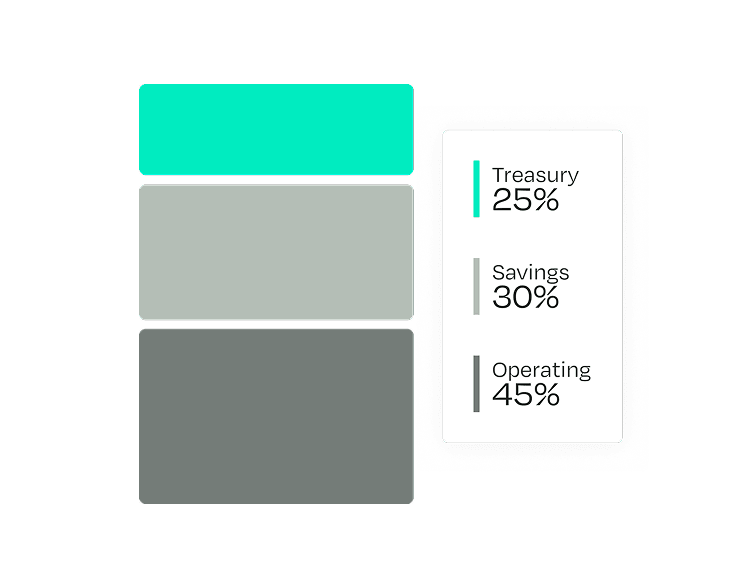

Our team helps you choose the right mix, set up auto-movements, and start earning without figuring it out alone.

Set rules once and Rho moves funds back to Checking automatically—so you can cover payroll, vendors, or ops without manual steps.

View estimated net yields for Treasury Bills and mutual funds based on your total deposit size.

| Total Deposits | Mutual Fund Net Yield* | T-Bills Net Yield† |

> $20M | 4.10% | 3.78% |

$10-20M | 4.00% | 3.68% |

$5-10M | 3.90% | 3.58% |

$2-5M | 3.80% | 3.48% |

$350K-2M | 3.65% | 3.33% |

| Mutual Fund Net Yield* | T-Bills Net Yield† |

> $20M | |

4.10% | 3.78% |

$10-20M | |

4.00% | 3.68% |

$5-10M | |

3.90% | 3.58% |

$2-5M | |

3.80% | 3.48% |

$350K-2M | |

3.65% | 3.33% |

This reflects the sought net yield based on 90-day Treasury Bill rates as of 10/30/2025 and an annual fee which ranges from 0.15% for deposits of $20M or more to 0.6% (the maximum annual fee) for deposits under $2M. Individual results may vary depending on the actual investment date and investment products selected. Past performance is not a guarantee of future performance results. The yield is variable and fluctuates without prior notice. The rate shown is net of fees. The amount of Treasury Bills available at a particular yield will depend upon the sellers’ offer size; any remaining cash balance after the purchase may not earn the same yield. *RBB Treasury LLC dba Rho Treasury, an SEC-registered investment adviser , and subsidiary of Rho seeks to earn net returns up to 3.78% annually on your idle cash. Net yield numbers as of 10/30/2025, and assumes total Rho deposits of $20M+ and an annual fee which ranges from 0.15% for deposits of $20M or more to 0.6% (the maximum annual fee) for deposits under $2M. Registration with the SEC does not imply a certain level of skill or training.

_

Securities in your Rho Treasury accounts custodied at Apex Clearing Corporation are covered by SIPC, up to $500,000 per customer, including up to $250,000 for cash. See https://www.sipc.org/for-investors/what-sipc-protects for complete details.

Rho Treasury is available for Rho clients that invest $350K or more (subject to compliance and partner review). Reach out to your Client Service representative to learn more.

Rho has direct integrations with QuickBooks Online, Sage Intacct, Oracle NetSuite, Campfire, and Puzzle.

We also make it easy to use CSV exports if you choose not to connect Rho with your accounting software.

When you use Rho Treasury at one of our custodial partners, your cash and investments are held in your company's name at our custodial partner, Apex Clearing Corp. (after July 2024) or Interactive Brokers LLC (pre-July 2024).

If you sell your treasury bills, you should be able to access the funds within 2-3 business days. Treasury bills sold before maturity are sold at market prices, which can fluctuate. That means that any treasury bills sold before maturity may lose value compared to your principal investment amount due to factors including, but not limited to, fluctuations in interest rates.

Rho Treasury is an RIA (registered investment advisor) and charges a management fee. Please see the ADV-2A Wrap Fee Brochure for further information regarding fees and Rho Treasury.

Visit the Rho Treasury product page to see the latest market rate. The yield may change at any time and without prior notice.

No, securities-based portfolios do not have FDIC insurance.

Rho Treasury is a cash management service that allows clients to invest non-operational funds in U.S. Treasury Bills and Mutual Funds, earning yield.

Investment management and advisory services are provided by RBB Treasury LLC dba Rho Treasury, an SEC-registered investment adviser. RBB Treasury LLC facilitates investments in securities: investments are not deposits and are not FDIC-insured. Investments are not bank guaranteed, and may lose value. Investment products involve risk and past performance does not guarantee future results. Registration with the SEC does not imply a certain level of skill or training. Treasury and custodial services are provided through Apex Clearing Corp. Treasury and custodial services are provided through Interactive Brokers LLC for clients with accounts opened prior to July 2024.