5 Pay Em Alternatives For Startups in 2025

Discover 5 top Pay Em alternatives for startups in 2025. Compare features, pricing, and reviews to find the best financial management tool for your business.

Rho Editorial Team

Businesses often seek alternatives to solutions like Pay Em due to the need for more tailored features, better pricing, or enhanced integration capabilities. Here are five notable alternatives:

Rho

Mesh

SAP Concur

BILL Spend & Expense

Navan

Pay Em is a global spend and procurement platform designed to streamline financial processes and promote accountability within organizations. It offers features such as corporate cards, agile approval workflows, budget control, and AI-powered invoice processing.

However, Pay Em doesn't fit all companies' needs, and some businesses find it lacking in essential features or flexibility. If you're looking for a better fit, we've rounded up five top alternatives—Rho, Mesh, SAP Concur, BILL Spend & Expense, and Navan—each offering unique advantages to meet different business requirements.

5 Alternatives to Pay Em

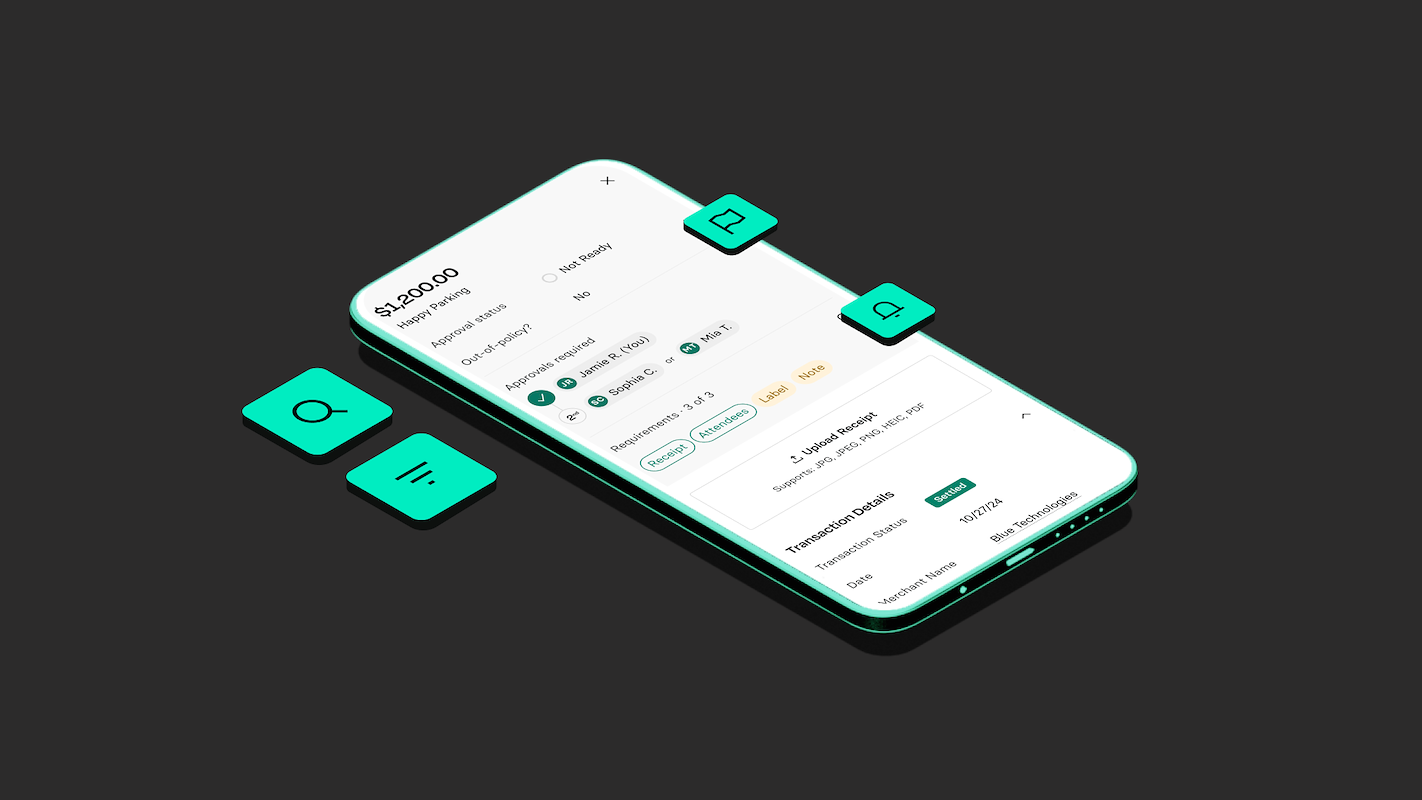

1) Overall Pick: Rho

At Rho, we're dedicated to providing a seamless business banking and spend management experience. Our platform is designed to support companies at every stage, from startups to large enterprises, helping them manage their finances efficiently and effectively.

Rho Key Features

Rho Platinum: Offers up to 2% cashback1 on transactions made using Rho's banking and card services.

AP Automation: Allows businesses to pay multiple vendors quickly and efficiently without incurring platform fees.

Expense Management: Streamlines the process of managing expenses by eliminating the need for traditional expense reports and ensuring all receipts are captured.

Rho Treasury: Offers a way to earn a yield on idle cash, with rates dynamically adjusted based on market conditions.

Rho Partner Portal: Designed specifically for accounting partners to manage their clients' finances more effectively.

Sync with Accounting Software: Integrates seamlessly with existing accounting software, enhancing workflow efficiency.

Virtual Cards: Provides the ability to create virtual cards for employees, specific dates, or particular vendors.

Unlike Pay Em, which focuses heavily on proactive expense management, Rho's AP Automation feature stands out by allowing businesses to pay hundreds of vendors in minutes with zero platform fees, making it a more efficient solution for large-scale operations.

Rho Pricing

We offer a straightforward and transparent pricing structure designed to make your financial management as simple as possible. Many of our essential services are free to use, ensuring you can focus on growing your business without worrying about hidden costs.

Here's a breakdown of our pricing:

$0 Same-Day ACH fees: No fees for same-day ACH transactions.

$0 Wire fees: No fees for wire transfers, except for international wires which may incur additional fees.

$0 Monthly plans: No monthly subscription fees for accessing Rho's services.

$0 Support fees: Free live support from day one without any additional charges.

$0 Subscription fees: No subscription fees for using Rho's platform.

$0 Checking account minimum fees: No minimum balance fees for checking accounts.

$0 Connected, in-platform capabilities: Free access to AP, Expense, and Accounting Automation features.

$0 Per-user fees: No fees per user for accessing the platform.

1% Foreign currency transfer: A 1% fee on foreign currency transfers.

You can find all the details about our pricing here.

Why Users Prefer Rho

Don't just take our word for it—hear directly from Rho's customers. Here's what real users have to say about why they prefer Rho over other solutions:

"Rho offers our users a one-touch experience for reporting company expenses on a corporate card. The text alert at the point of purchase means before they leave the counter or stand up from the table, the expense report item can be completed."

"The company implementation of Rho was easy and took less than 2 hours. We sync with Quickbooks Online seamlessly, which has saved the finance department 60 hours per month and delayed a planned headcount addition indefinitely."

"Rho allows a single person to take care of the entire company's finances quickly - everything from checking account, AP, expenses, to treasuries."

Want a firsthand look at Rho? You can request a free demo here.Source: Rho Reviews & Product Details

2) Mesh

Mesh Payments is a comprehensive travel and expense management solution designed for modern global enterprises. It integrates smart corporate cards, expense management automation, and travel management into a single system, providing real-time visibility and control over expenses while promoting compliance and reducing costs.

Mesh Key Features

Mesh Payments offers a comprehensive travel and expense management solution designed for global enterprises, integrating corporate cards, expense management, and travel bookings into a single system.

Expense Management Automation: Centralizes and controls expenses in real-time with advanced spend controls, approvals, and accounting automations.

Agnostic Travel Management: Provides flexibility with online, offline, and direct booking, connecting preferred TMCs, and enforcing policies.

Global Corporate Cards: Smart cards with embedded compliance and AI-powered receipt collection in local currencies.

AI-Driven Compliance & Automation: Simplifies travel and expense management with AI-powered automation for receipt collection, data extraction, and accurate coding.

Real-Time Reporting: Tracks and controls spend in real-time with dashboards and analytics.

Mesh Pricing

Mesh offers tiered pricing plans to cater to different business needs, from free basic services to customizable enterprise solutions.

Pro: Manage, control, and automate global spend management. (Free)

Premium: Powerful tools to control and scale spend management and operations to match global growth. ($10 per user, per month)

Enterprise: Complete spend and travel control with the flexibility to adapt to complex, fluid business needs. (Custom pricing)

Drawbacks To Mesh

General user reviews of Mesh Payments highlight its ease of use and intuitive interface, but some users have noted issues with card acceptance and additional fees.

"Great customer support whenever I have needed to contact them, and generally easy to make online payments and in-person payments with the linked card." - Piers B.

"Reduced the amount of manual work I was doing on reimbursements each month." - Shifra S.

Source: Mesh Payments Reviews 2025: Details, Pricing, & Features | G2

3) SAP Concur

SAP Concur is a comprehensive software solution designed to automate and streamline expense management, travel booking, and invoice processing. It connects financial data and helps businesses take control of their spending, offering a range of products such as Concur Expense, Concur Invoice, and Concur Travel to manage various financial processes efficiently.

SAP Concur Key Features

Here are some of the most notable features of SAP Concur:

Concur Expense: A tool designed to simplify the expense reporting process by allowing users to submit expenses from any location, thereby improving efficiency and accuracy in expense management.

Concur Invoice: This feature automates the accounts payable process, integrating it with other financial systems to streamline invoice management and reduce manual errors.

Concur Travel: A travel management solution that captures travel bookings from various sources, providing a unified view of travel expenses and ensuring policy compliance.

Concur Detect: A fraud detection tool that helps organizations identify and mitigate expense fraud, enhancing compliance and reducing financial risk.

Concur Trip Link: A feature that integrates travel bookings made outside the corporate travel system, offering a comprehensive overview of travel expenditures and improving travel policy adherence.

SAP Concur Pricing

SAP Concur provides customized pricing based on the specific needs and details of the business.

Travel & Expense: A combined solution for managing both travel bookings and expense reports.

Expense Only: A solution focused solely on managing and automating expense reports.

Invoice: A solution for managing and automating invoice processing.

Drawbacks To SAP Concur

General user reviews of SAP Concur are mixed, with users appreciating its automation but often criticizing its complexity and slow performance.

"SAP Concur offers a clean interface and once you're familiar with the workflow, it becomes second nature." - Thanushree B.

"Once you get used to the program, its a fairly easy process to upload expenses and receipts. Allowed me to track my expenses and go back and review/research to organize by specific trip." - Dominic F.

Source: SAP Concur Reviews

4) BILL Spend & Expense

BILL Spend & Expense combines a powerful company card with expense management software to streamline reporting and give users more control over their spending. It is designed to provide real-time visibility and customizable control over business finances.

BILL Spend & Expense Key Features

Business Credit: Provides businesses with access to credit through an online application process, suitable for businesses of various sizes.

Expense Management: Offers software that simplifies the management of expenses, removing the need for traditional expense reports.

Budget Management: Allows businesses to set and control budgets with customizable policies and spend controls.

Mobile App: Enables team members to manage spending and complete transactions in real-time using a mobile application.

Virtual Cards: Issues virtual cards to help businesses prevent fraud and control spending.

BILL Spend & Expense Pricing

BILL Spend & Expense offers a free-to-use model for both businesses and accountants, with no monthly user fees.

Essentials: Basic AP/AR features with manual integration, starting at $45/user/month.

Team: Granular AP/AR controls with automatic sync, starting at $55/user/month.

Corporate: Advanced AP/AR management with customization, starting at $79/user/month.

Enterprise: Custom pricing for enhanced security and multi-location capabilities.

Spend & Expense (Free): Free software for managing spend and expenses with corporate cards.

Drawbacks To BILL Spend & Expense

General user reviews of BILL Spend & Expense highlight its ease of use and effective expense management, but some users have noted issues with customer support and integration problems.

"The Bill has been a game-changer for our bookkeeping workload! It's rare that a new app or technology actually delivers on its promises, but this system has exceeded our expectations" - Sarah M.

"BILL Spend & Expense is incredibly easy to use, which made onboarding and setup a smooth process from the start." - Heather C.

Source: BILL Spend & Expense Reviews 2025: Details, Pricing, & Features | G2

5) Navan

Navan is a corporate travel and expense management platform designed to simplify and streamline business travel and expense processes. It offers an intuitive interface for booking travel, managing expenses, and ensuring compliance with company policies.

Navan Key Features

Here are some of the most notable features of Navan:

Navan Travel: A platform feature that allows employees to book corporate travel from a wide range of options while ensuring compliance with company spending policies.

Navan Expense: A tool for managing corporate expenses that automates the process from transaction to reconciliation, enhancing productivity and optimizing savings through AI-driven insights.

Navan Connect: A feature that integrates existing credit cards into the Navan system, facilitating automatic transaction approval and reconciliation while maintaining card benefits.

Navan Rewards: An incentive program that rewards employees for booking travel under budget, encouraging cost-effective travel planning.

24/7 Expert Support: A service offering continuous support for travelers, including premium assistance for VIPs through experienced agents.

Navan Pricing

Navan offers a free plan for small companies and a customizable plan for large organizations.

Navan Business: Free for companies up to 200 employees, includes travel and expense features.

Navan Enterprise: Custom pricing for large organizations, includes advanced travel and expense features.

Drawbacks To Navan

General user reviews of Navan highlight its ease of use and efficient expense management, but some users have noted issues with booking and hotel charges.

"Navan was provided by the company I work with, it looked like a good idea to use the points from my business trips for my personal trips, until I've booked my first (and last) personal trip." - Smirnova K.

"I use Navan through work for all of my work travel needs and it is SO easy to use." - Reem C.

Source: Navan (Formerly Trip Actions) Reviews 2025: Details, Pricing, & Features | G2

How to select the right Pay Em alternative?

Tips for Selecting the Right Pay Em Alternative

Assess Your Needs: Identify the specific features and functionalities your business requires, such as expense management, travel booking, or AP automation.

Consider Integration: Ensure the platform integrates seamlessly with your existing accounting and financial software to streamline operations.

Evaluate Pricing: Compare the pricing structures of different platforms to find one that offers the best value for your budget.

Read User Reviews: Look at user feedback to understand the strengths and weaknesses of each platform from a real-world perspective.

Scalability: Choose a solution that can grow with your business, offering features that cater to both current and future needs.

Customer Support: Consider the quality of customer support provided, as this can be crucial for resolving issues quickly and efficiently.

Try Rho: While evaluating options, consider Rho for its comprehensive features and user-friendly interface, which many businesses find beneficial.

Getting started with the best Pay Em alternative

Each of the alternatives to Pay Em offers unique features and benefits, making them suitable for different business needs. However, if you're looking for a comprehensive solution that integrates seamlessly with your existing systems and offers robust financial management tools, we recommend Rho.Ready to experience the benefits of Rho for yourself? Request a demo today and see how our platform can streamline your financial operations and help your business thrive.

Rho is a fintech company, not a bank or an FDIC-insured depository institution. Checking account and card services provided by Webster Bank N.A., member FDIC. Savings account services provided by American Deposit Management Co. and its partner banks. International and foreign currency payments services are provided by Wise US Inc. FDIC deposit insurance coverage is available only to protect you against the failure of an FDIC-insured bank that holds your deposits and subject to FDIC limitations and requirements. It does not protect you against the failure of Rho or other third party. Products and services offered through the Rho platform are subject to approval.The Rho Corporate Cards are issued by Webster Bank N.A., member FDIC pursuant to a license from Mastercard, subject to approval.

Investment management and advisory services provided by RBB Treasury LLC dba Rho Treasury, an SEC-registered investment adviser and subsidiary of Rho. Rho Treasury investments are not deposits or other obligations of Webster Bank N.A., or American Deposit Management Co.'s partner banks, are not FDIC insured, are not guaranteed and may lose value. Investment products involve risk, including the possible loss of the principal invested, and past performance does not future results. Treasury and custodial services provided through Apex Clearing Corp. and Interactive Brokers LLC, registered broker dealers and members FINRA/SIPC.

1 Up to 2% cashback; terms and conditions apply. See eligibility and complete Rho Cashback Rewards Program terms and conditions here.This content is for informational purposes only. It doesn't necessarily reflect the views of Rho and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.