Offer founders exceptional financial solutions and support

Fast track your companies to Rho Platinum, where they can get the best rates and award-winning, 24/7 personalized support (via phone, text, and email).

Industry-leading cashback rates, portfolio management, and hands-on support to help your startups grow.

Get your founders exceptional financial solutions, streamlined capital deployment, and exclusive networking opportunities.

Fast track your companies to Rho Platinum, where they can get the best rates and award-winning, 24/7 personalized support (via phone, text, and email).

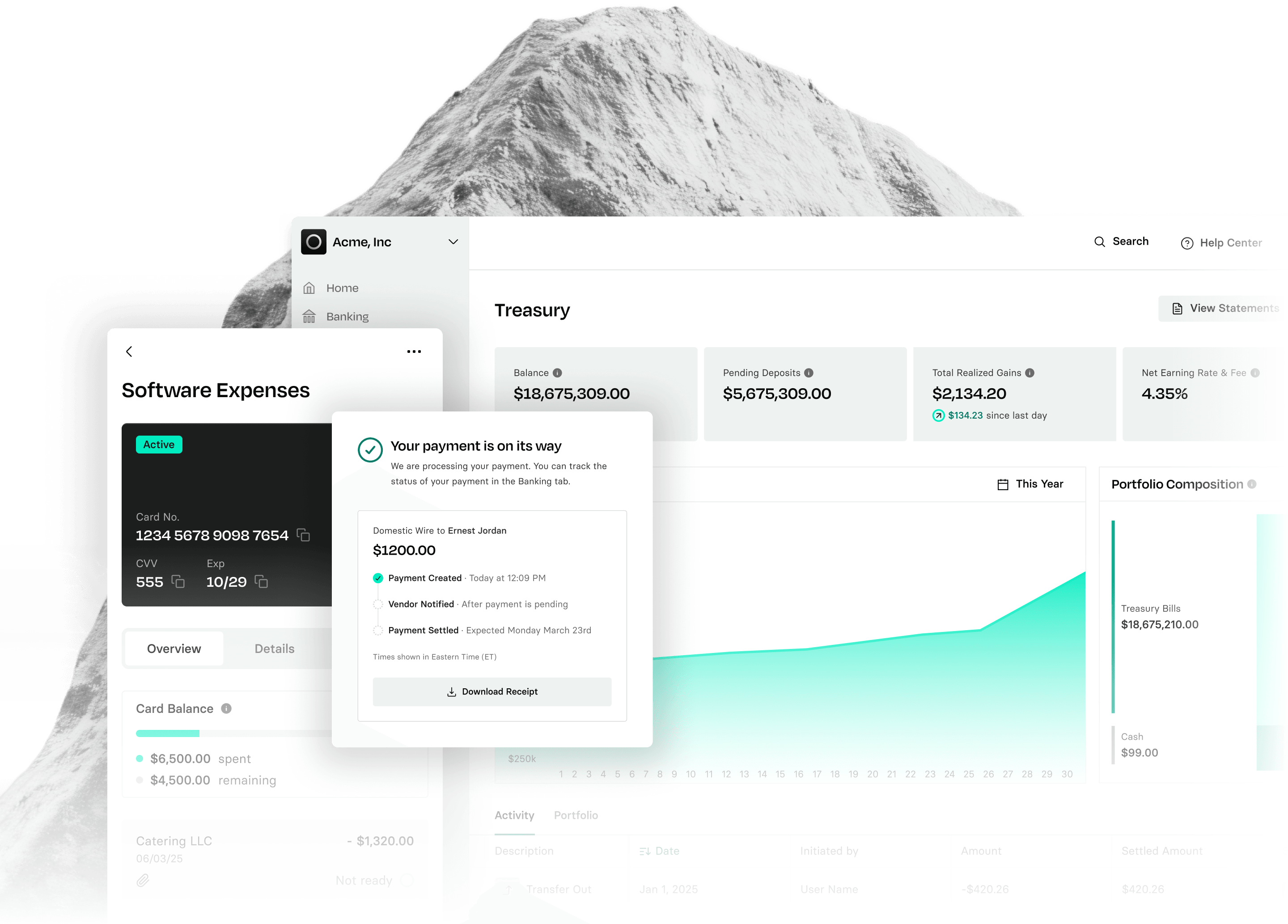

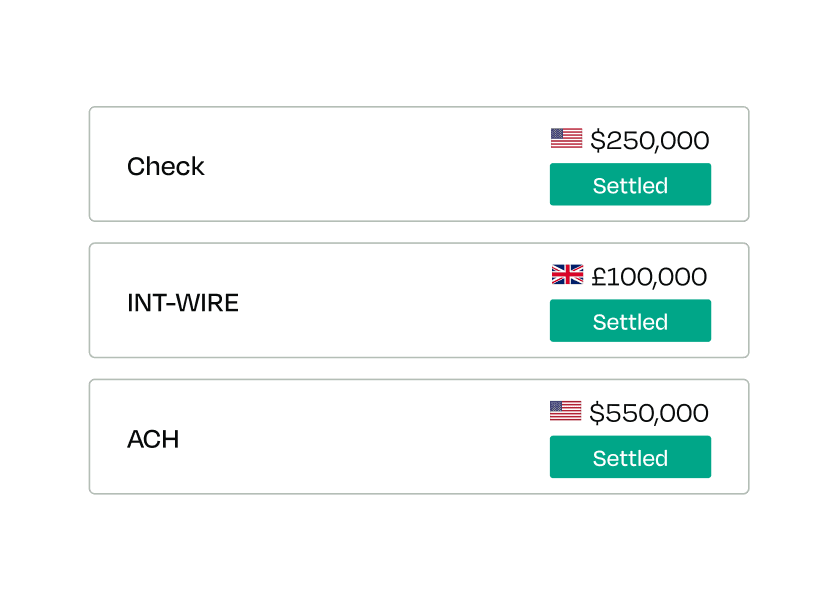

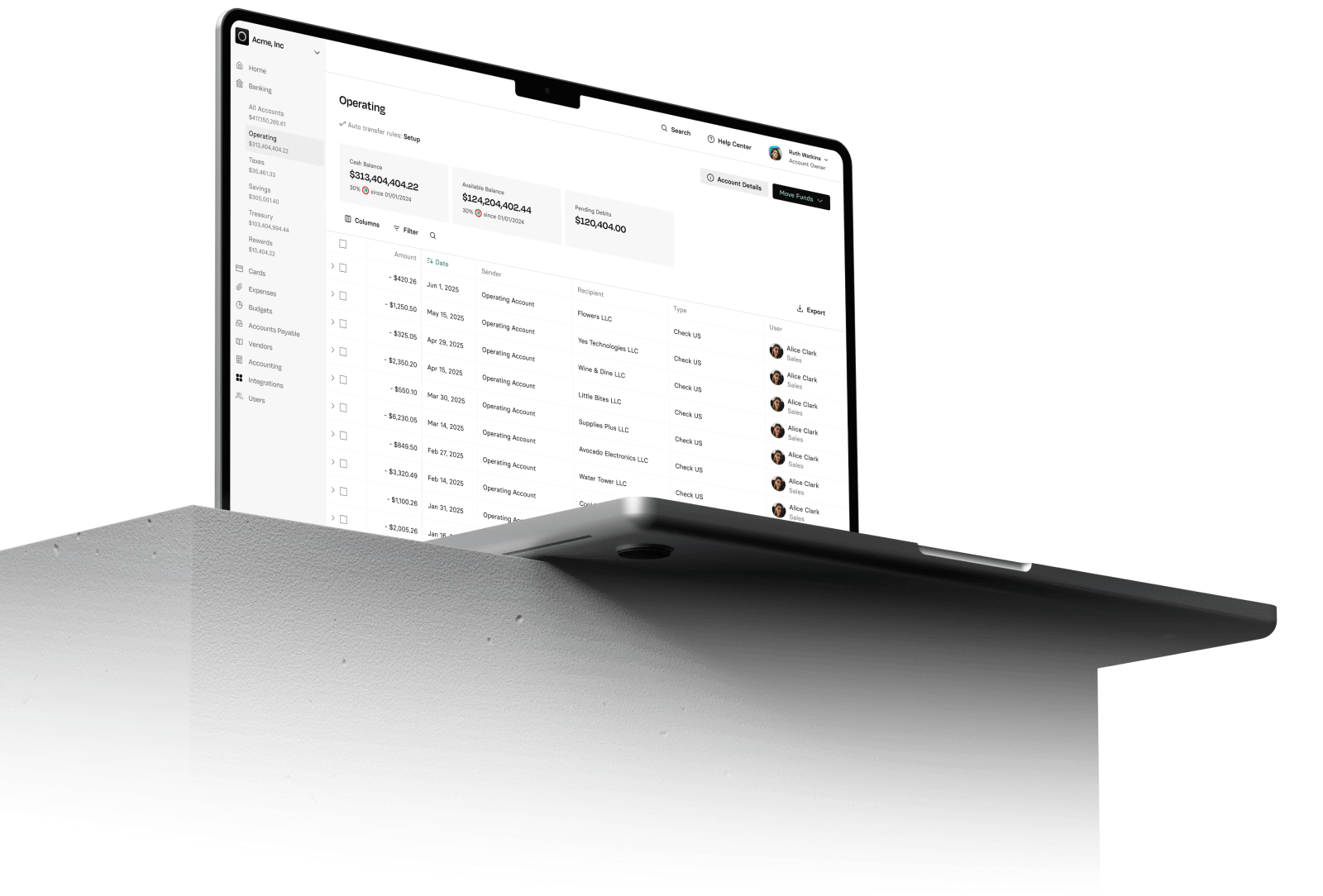

Deploy funds to your startups securely and efficiently, managing all your investments from one platform.

We built Rho the hard way, by being the fintech with one of the largest partner bank, Webster, with whom we have a direct connection with.

Access a community of high-caliber founders, investors, and LPs curated precisely to your investment goals.

_

At Rho, we don't believe in watered-down experiences. Our founder, VC, and LP events consistently set the industry standard for event quality, attendance, and audience curation. We host over 300 private and curated events each year with VCs.

_

Expand your pipeline with tailored introductions to exceptional, pre-vetted founders aligned directly to

your fund’s thesis.

Rho is a fintech company, not a bank. Checking and card services provided by Webster Bank, N.A., member FDIC; savings account services provided by American Deposit Management Co. and its partner banks.

Explore the case studies to see how Rho simplifies business banking.

Seasoned business owners, operators, and CFOs optimize cash flow and bank* with confidence using Rho.

_

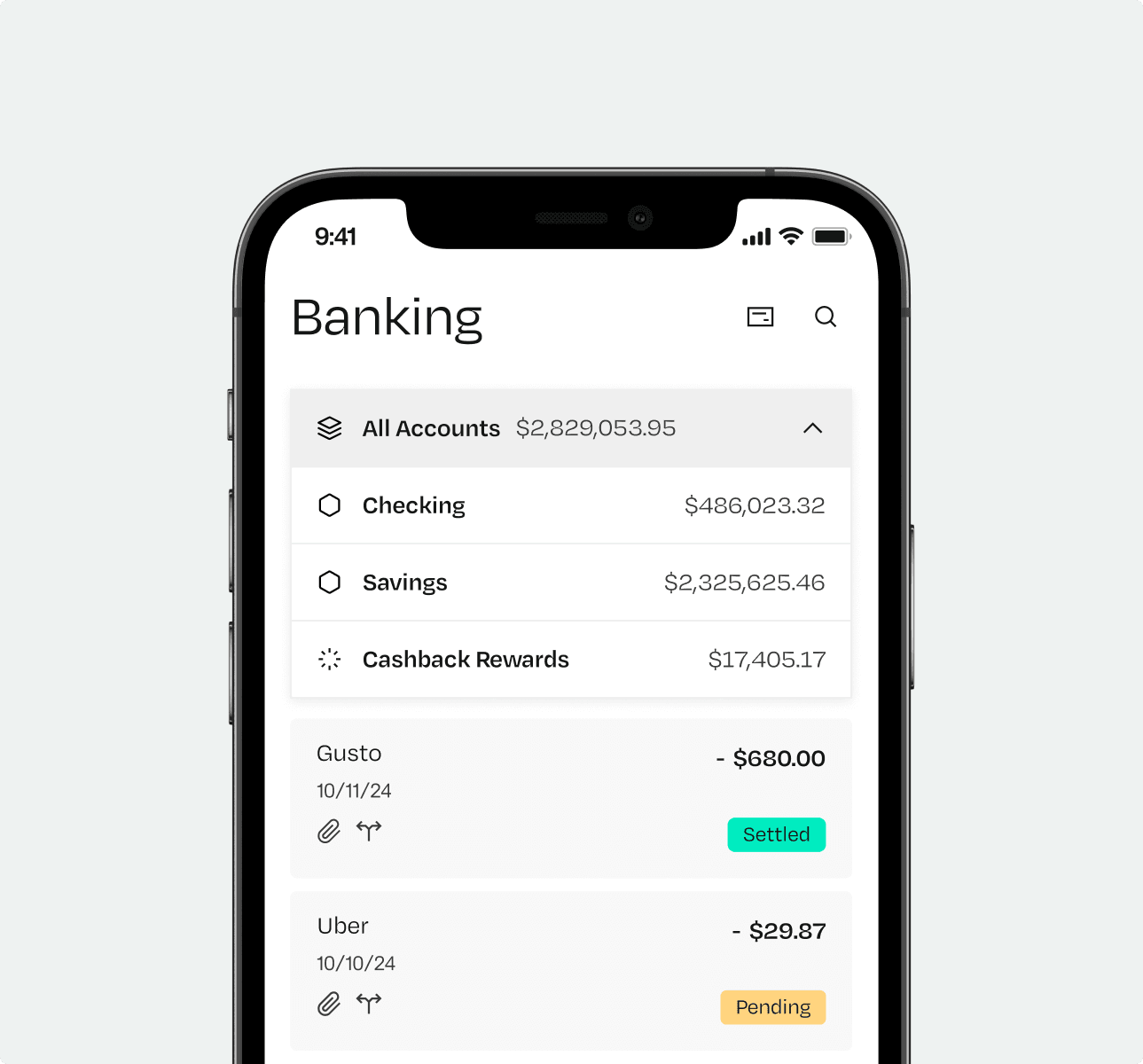

Organize your cash with multiple fee-free operating accounts and count on 24/7 customer support.

_

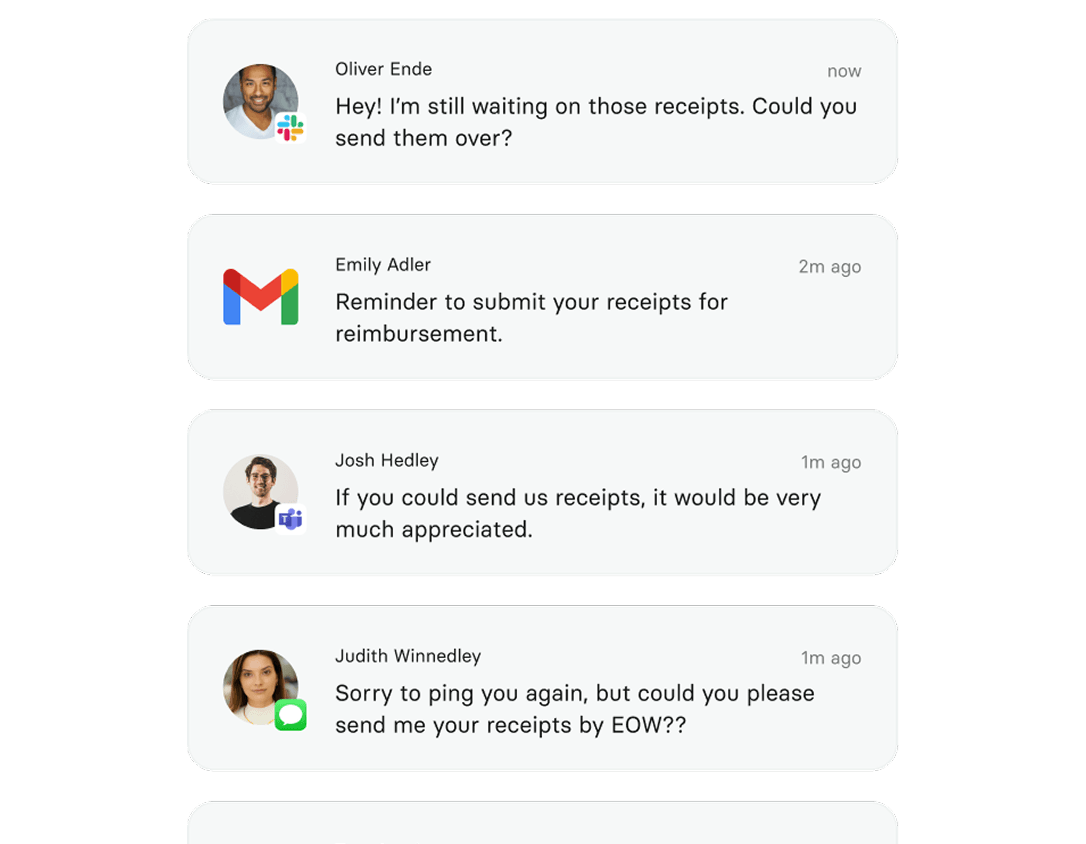

You lack real-time clarity over T&E spending and spend far too many hours chasing down late receipts and approvals.

Rho is a fintech company, not a bank. Checking and card services provided by Webster Bank, N.A., member FDIC; savings account services provided by American Deposit Management Co. and its partner banks.

Get exclusive access to up to $1M+ perks and rewards.

Absolutely. Contact the Rho VC Partnerships team to customize these opportunities and introductions.

Your fund gains exclusive invitations to premium, invite-only events specifically designed for VCs, LPs, and influential founders in the startup ecosystem. These carefully curated gatherings focus on facilitating meaningful discussion, networking with top-tier peers, and access to exclusive industry insights and opportunities. We host over 200 of these private events every year.

Rho’s VC partnerships team actively curates strategic introductions between investors, LPs, and high-caliber startup founders within our network. By thoroughly vetting and aligning opportunities based on investment criteria and mutual fit, we create targeted, value-driven connections that fuel successful partnerships.

Yes. Portfolio companies that qualify for our premium Rho Platinum tier benefit from dedicated account representatives and customer success personnel. These specialists proactively support companies, helping address specific needs and ensure frictionless banking experiences.

Rho provides highly personalized, human-centric support with 24/7 availability. Account holders receive direct, live assistance from experienced account specialists via phone, text, and email, in addition to powerful self-service tools and resources.

We can provide special promotions for portfolio companies and funds based on the fund size, focus, and location. Contact our team for more information.

Rho’s platform allows VCs to seamlessly manage and securely deploy funds directly to portfolio companies, centralizing transactions and providing transparent tracking from one intuitive dashboard.

Users can often onboard and begin using Rho’s banking solutions same-day.

The typical criteria for is to set up Rho as the central bank account used for processing payroll payments, and ensure business revenue flows through your Rho Checking account. This includes depositing and retaining at least 50% of your company’s assets at Rho.

Rho utilizes advanced cybersecurity and fraud protection strategies, which include multi-factor authentication, data encryption, secure transaction vetting procedures, ongoing monitoring for fraudulent activity, and regular security audits and assessments. Additionally, our team continuously monitors for security threats and deploys stringent measures to ensure financial data protection.

Yes, funds deposited with Rho are FDIC-insured up to $250,000 per depositor, per insured bank, for each account ownership category. Rho ensures customer deposits receive FDIC coverage through partnerships with reputable, fully insured banking institutions.

Rho employs bank-level security protocols and rigorous risk management practices to safeguard your funds and transactions. Our platform adheres to industry best practices and regulations, including strict compliance standards, continuous monitoring, robust encryption, two-factor authentication, and proactive fraud detection measures.